The Central Bank of Nigeria (CBN) shocked the local cryptocurrencies community on Friday when it issued a regulatory warning to financial institutions from doing business with crypto exchanges and individuals dealing with crypto.

The letter was a reminder to all financial institutions reminding them that “dealing in cryptocurrencies or facilitating payments for cryptocurrency exchanges is prohibited,” in line with a circular issued in 2017.

The regulations could limit the daily transactions of crypto in the country, which has drastically increased due to the Naira’s instability. These rules prevent users and cryptocurrency exchanges from using bank accounts or credit card linked to them in performing any crypto-currency related transaction.

This means that cryptocurrency exchanges in the country won’t collect cash from a customer’s bank account.

Nigeria’s central bank also directed deposit money banks, non-bank financial institutions, and other financial institutions to identify and shut down accounts of “persons and or entities transacting in or operating cryptocurrency exchanges within their systems.” Besides, the central bank warned that breaching the rules will attract appropriate regulatory sanctions.

The announcement came as a shocker and will mean that several cryptocurrency exchanges and companies will be greatly affected. Some of the affected include Yellow Card, which, apart from Nigeria, is currently available in eight African countries, including Kenya, Patricia, BuyCoins, to name a few.

However, the restriction of bank-crypto transactions doesn’t seem like the end to crypto use in Nigeria.

To be clear, the Central bank of Nigeria has not labeled crypto as explicitly illegal.

Bottom line: Crypto has not been declared illegal in Nigeria – yet?

Cryptocurrency in Nigeria

Nigeria is a huge market for crypto in Africa.

In 2020, a report ranked the West African country number one in peer-to-peer monthly volumes averaging $25.8 million, followed by South Africa and Kenya. In five years to 2020, Nigeria trailed the United States as the number two Bitcoin P2P market, with over $500 million worth of Bitcoin transacted – an indicator of how huge crypto use in the country is.

Backlash

Obviously, such a directive was anticipated to be met with fury and anger. Many criticized the “hasty” decision, but some were optimistic about the outcome of such a shocking move.

“The new CBN policy will only encourage P2P trades which are even more unregulated unlike what Patricia has where we have KYC done on all users to ascertain their identity before any trade or exchange happens,” the Chief Marketing Officer of crypto payments company, Patricia, said in an interview.

In a follow-up statement issued on Sunday, February 7th, the CBN cleared the air amid backlash on why it decided to ban financial institutions from dealing with crypto. It said the circular is a reminder of a circular dated January 12, 2017, which forbade banks “not to use, hold, trade and/or transact in cryptocurrencies.”

“As regards our recent policy pronouncement, it is important to clarify that the CBN circular of February 5, 2021, did not place any new restrictions on cryptocurrencies,” the CBN said. It justified the decision saying other countries that have placed certain restrictions on crypto use, citing what most regulators have raised eyebrows about these asset classes’ use.

The decision was based on the significant investment risks related to crypto over volatility, money laundering, terrorism financing, illicit fund flows, and criminal activities.

Furthermore, it mentions tax evasion and that some cryptocurrencies are “widely used as speculative assets rather than as means of payment,” which leads to significant volatility.

A good example is the DOGE coin, which has been involved in a social media pump recently — rising over 55 percent yesterday and is up 1,285.34% year to date as at the time of wiring, according to CoinDesk.

Future of Crypto in Nigeria

With all the drawbacks considered, the Central Bank of Nigeria said it “has no comfort” in crypto use at this time. But will there be a future? That remains to be seen, of course. The door has seemingly not yet been shut down completely.

But for the time being, the central bank says it “will continue to do all within its regulatory powers to educate Nigerians to desist from their use and protect our financial system from the activities of fraudsters.”

Crypto Regulation in Africa

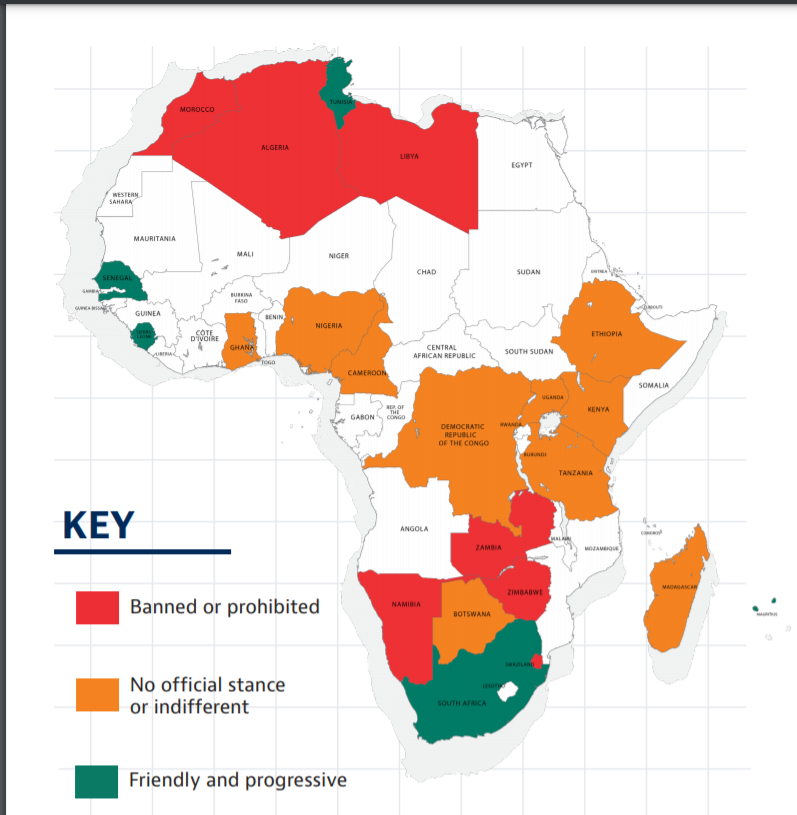

Africa still lags behind other continents on the adoption of cryptocurrency. According to the Arcane Research Report on the State of Crypto in Africa, the situation is further due to regulators’ resistance and fundamental aspects like low smartphone penetration and poor infrastructure.

Over 60 percent of African governments haven’t specified if they’re pro-crypto or against it on the regulation front. Some have banned cryptocurrency use completely, like Zambia, Namibia, and Zimbabwe. Like in Kenya, others haven’t specified their stand, despite the great rankings on the African crypto map. And some are friendly like South Africa and Senegal.

Follow us on Telegram, Twitter, Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates.