LOOP to Temporarily Go Offline on September 24 at 11:59 PM for System Upgrade, Back by 2:00 AM

Behind the short silence lies a bigger story about loans, device financing, and the growing complexity of LOOP’s expanding ecosystem.

At 23:59 on Wednesday, 24 September 2025, the LOOP app will go dark. For just over two hours—until 02:00 on 25 September—the app and all LOOP services will be offline. Two hours may feel like a blip. But in digital banking, even a blip can carry weight.

For users, the discomfort is predictable: delayed transactions, paused access, and an app that doesn’t respond. But for LOOP, this scheduled downtime is more than a technical necessity—it’s a signal of where the bank is headed: toward a leaner, more interconnected product suite, backed by more rigorous infrastructure.

Recent Moves: Between Interface Tweaks and Bigger Bets

This isn’t LOOP’s first rodeo of iteration. The bank has, throughout 2025, been quietly layering features and partnerships that expand its scope.

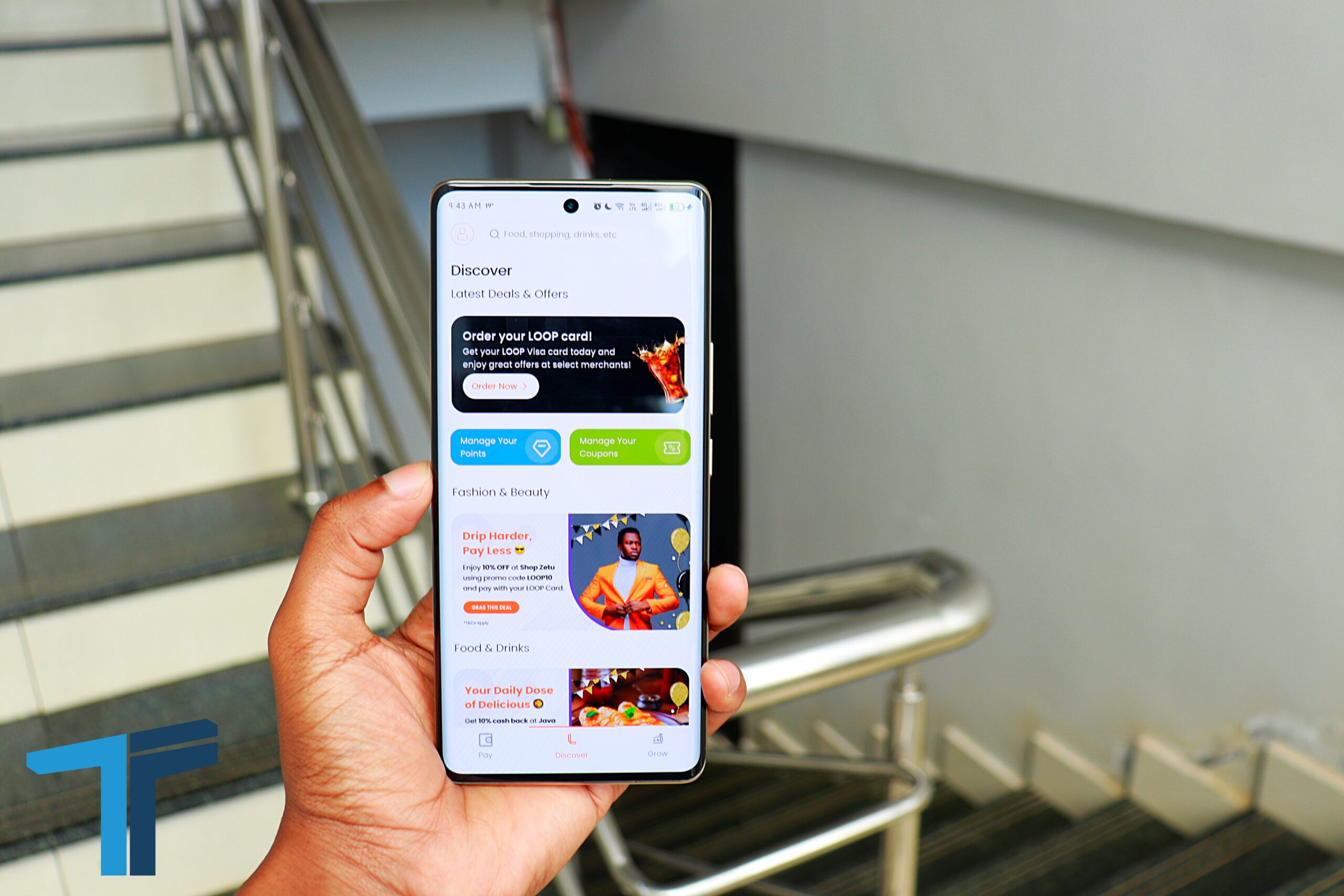

- Interface redesigns: Early in 2025, LOOP delivered a fresher, simplified user interface—one that reduces friction, surfaces what customers use most, and pushes nonessentials into the background. It’s not just aesthetics. It’s about speed and clarity.

- Credit-on-demand: The “Quick Loan” option inside the Grow section has been active, letting customers access small tickets of credit with minimal friction. As fintechs know, loans are fertile ground for both risk and reward—and the decision flows behind them are never simple.

- Partnership with bolttech / product bundling: In late August, LOOP teamed up with insurtech bolttech to launch LOOP Flex, a combined device financing and protection product. That kind of embedded insurance model demands tight backend work: claims flows, device verification, settlement mechanisms—all moving parts that must align.

- Device promotions and rebates: A recent OPPO-device promotion offering 10% cashback for purchases made via LOOP ties LOOP deeper into hardware ecosystems, pushing growth via commerce as much as via financial services.

Each of these tells a story. They suggest that the upcoming maintenance is not just maintenance. It likely underwrites the connective tissue that will deliver new services, ensure reliability for existing ones, and support those commerce-linked features that require real-time, seamless experiences.

Why This Upgrade Might Be More Than Just Patches

Routine maintenance often involves code refactoring, bug fixes, performance tuning, or security patches. But when a bank is expanding services—especially with third-party partners—you often need more than that.

- System integrations with external services (e.g., the bolttech protection component) typically require adjustments to APIs, data schemas, and user verification flows.

- Payment rails and merchant systems need alignment if you’re doing device financing or product loans. If OPPO devices are being sold via promotions tied to LOOP, the backend must reliably recon with merchants.

- Loan decision logic and risk monitoring for those quick loans likely need stress testing and updated rules. If user demand spikes, the system must hold.

Because LOOP chooses a planned downtime rather than a hidden, phased rollout, it suggests these changes touch multiple layers—app frontend, business logic, data stores, maybe even infrastructure like database or server capacity. These aren’t trivial tweaks.

Building Trust in a Moment of Absence

Consumers tolerate downtime when they believe in the reliability, transparency, and follow-through of the product. LOOP app’s announcement is clean and professional. But how much more powerful would it be to couple the outage with a promise: “Here’s what will change” and then later, “Here’s what did change”?

Best-practice in financial tech increasingly includes visible version logs, short post-upgrade briefs, and in some cases dashboards of stability metrics. These build trust. They turn silence into something like proof of work.

What This Tells Us About LOOP’s Strategy

Peeling back the patterns, several strategic ambitions emerge:

- Vertical expansion: LOOP is expanding from core banking (deposits, payment, savings) into credit (loans on demand), embedded insurance, device finance. This suggests revenue diversification and deeper customer lock-in.

- Partnership leverage: Rather than building every component in house, LOOP is leaning on experts (like bolttech) for non-core functions. That is efficient—but it raises dependency and integration risk.

- User experience as battleground: Simplified UI, instant credit, frictionless commerce tie-ups—all are bets that customers value seamlessness. If LOOP fails in execution (e.g. buggy features, slow performance after upgrade), those bets lose value fast.

- Operational maturity: Behind every new feature is infrastructural cost. The upgrade window suggests LOOP is investing in systems that can support growth without collapsing under it. The question is whether the internal operation (engineering, QA, customer support) is scaling at the same pace.

What We Still Don’t Know

There are gaps in public knowledge. These are the questions LOOP might choose to answer—or leave hanging:

- Exactly which components are being upgraded: security layers, payment APIs, loan logic or perhaps merchant partner integrations?

- Whether there will be visible post-upgrade release notes or a developer log that spells out what changed.

- How LOOP is monitoring stability and incidents following this rollout. Will outage metrics be published?

- How the bolttech / device financing / protection flows are going to be integrated in the user journey: is it optional, bundled, financed by LOOP, or via third-party credit partners?

- Whether this maintenance window is a one-off or part of a more regular cadence. Frequent downtime, even if planned, can fatigue users.

What Customers Should Do Before and After

To make this pause less disruptive, here’s how LOOP users can stay ahead:

- Move urgent transactions to before 23:59 (24 Sept).

- Avoid starting new device or loan-linked purchases that might require immediate verification. If buying an OPPO device for the cashback, confirm whether the promotion or financing depends on systems being live.

- After the outage, test core things—login, check balances, make a small payment, try the “Quick Loan” if applicable. Any glitches, report them early.

- Keep an eye out for communications: post-upgrade notes, support messages, or app-store update logs. These often reveal more than the announcements.

Final Word: More Than a Scheduled Pause

In isolation, LOOP app’s two-hour system upgrade is minor. But in context, it looks like part of a turning point: beyond app redesigns, beyond single product pushes. This is the connective work that underpins reliability and new features. When done well, this kind of upgrade is invisible—customers notice what improves, not the interruption. When done poorly, even a short downtime can reverberate in trust.

If LOOP emerges from this window with solid performance, visible changes, and clear communication, it will have turned a temporary off-switch into a long-term advantage.

Go to TECHTRENDSKE.co.ke for more tech and business news from the African continent.

Mark your calendars! The TechTrends Pulse is back in Nairobi this October. Join innovators, business leaders, policymakers & tech partners for a half-day forum as we explore how AI is transforming industries, driving digital inclusion, and shaping the future of work in Kenya. Limited slots – Register now – here.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke