How Wealth-Tech Startup Ndovu is Changing the Investment Landscape in Kenya

Ndovu, the Kenyan wealth tech startup is revolutionizing the investment landscape by making financial markets more accessible to a broader segment of the population.

Founded in 2020 by Radhika Bhachu, Ro Nyangeri and Gianpaolo De Biase, and available on iOS and Android, Ndovu allows users to invest as little as KES1000 in local and global listed companies. The company says it aims to democratize wealth creation through user-friendly digital platforms and affordable investment opportunities.

Ndovu was founded upon the realization that current investment options in Kenya lock out the vast majority due to complexities in market access and high management fees.

At the time of launch, the startup has already secured pre-seed funding from 4DX Ventures, Plug and Play Tech Center, Future Africa, and Oui Capital.

“Our idea was born out of our passion to improve financial lives across Africa. Our vision is to provide every African, regardless of income level or financial knowledge, with the right tools to grow their wealth. We believe educating our people on how to make their money work for them will bring us one step closer to reducing poverty on the continent,” Radhika said.

Ndovu Fund

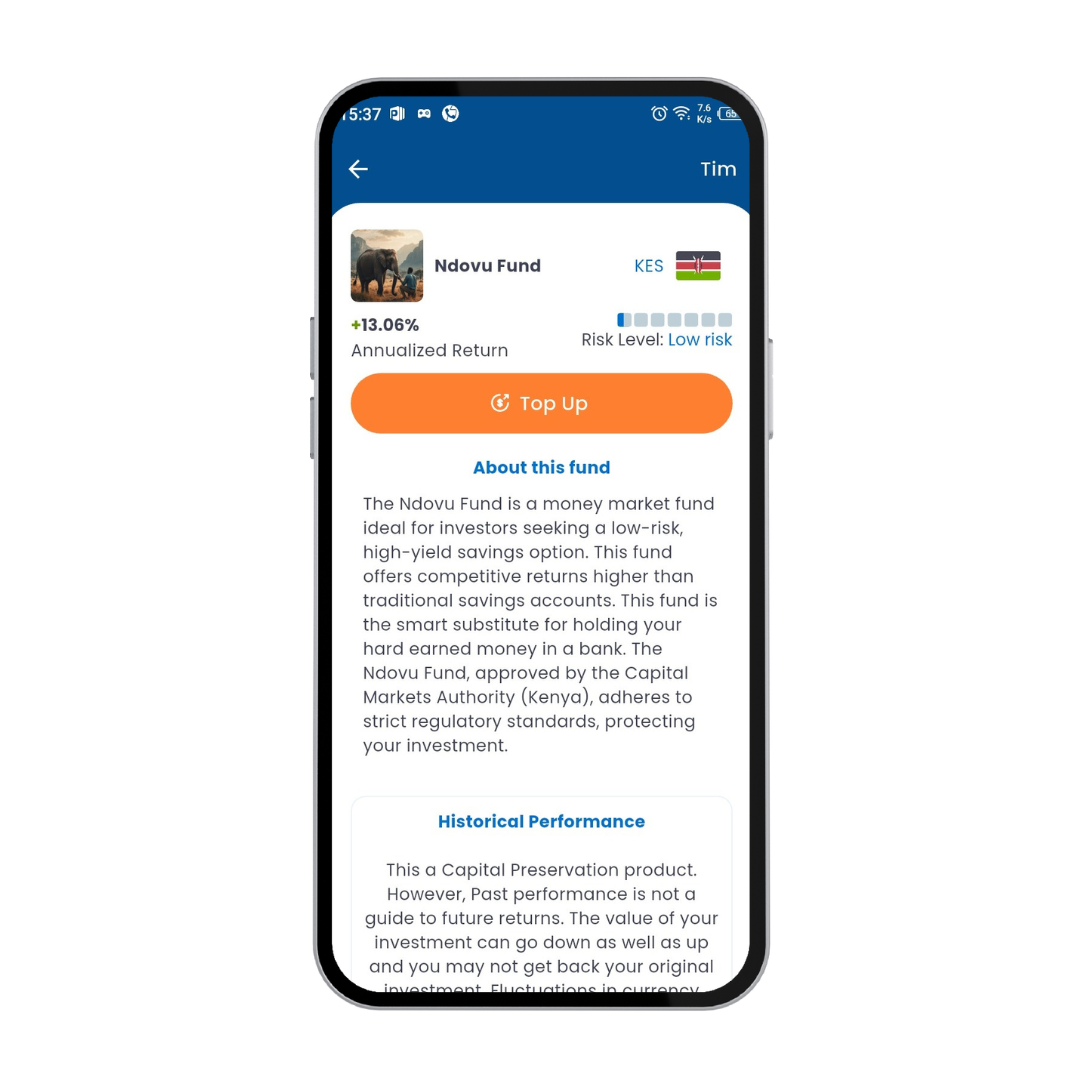

In August 2024, Ndovu launched its Money Market Fund (MMF), known as the Ndovu Fund, after receiving approval from the Capital Markets Authority (CMA) of Kenya. This fund allows individuals to start investing with as little as KSh 500, significantly lowering the barrier to entry for first-time investors. Its design targets to provide investors with a flexible, stable and relatively low-risk investment option that offers competitive returns, making it an ideal option for both first-time and seasoned investors.

The Ndovu Fund invests in a diversified portfolio of high-quality, short-term securities, including Treasury Bills, Treasury Bonds, and highly-rated commercial paper, aiming to provide competitive returns while maintaining liquidity and minimizing risk.

Ndovu Fund has posted impressive returns, offering interest rates of 13.06% as of December 31, 2024, solidifying its position as a strong investment choice in the current economic climate. This performance outpaces inflation rates, ensuring real value growth for investors seeking stable and competitive returns. The fund’s strategic asset allocation and expert management have contributed to this robust performance, making it an attractive option for both seasoned and new investors looking to preserve and grow their wealth in a dynamic market environment.

During the launch, Radhika Bhachu, co-founder and CEO of Ndovu Wealth Limited, emphasized the company’s mission saying “We are fostering a culture of saving and investing in Kenya. With this fund, we’re empowering Kenyans to take control of their financial future by offering a platform to start investing, diversify their portfolios, and meet their long-term goals—all while earning competitive returns.”

Leveraging Technology for Financial Inclusion

Ndovu’s digital platform simplifies the investment process, enabling users to manage their portfolios conveniently through mobile applications. The platform offers access to both local and global financial markets, providing personalized financial advice tailored to individual goals and risk appetites. This approach aligns with global trends where there is a growing demand for financial products that offer safety, liquidity, and moderate returns.

Operating under a fund management license from the CMA, Ndovu ensures adherence to regulatory standards, bolstering investor confidence. The company says its commitment to transparency and security is further reinforced by its regulation under the Institute of Certified Investment & Financial Analysts (ICIFA), the Communications Authority, and the Nairobi Securities Exchange.

Impact on Kenya’s Financial Landscape

By lowering investment thresholds and leveraging technology, Ndovu is playing a pivotal role in promoting financial inclusion in Kenya. The Ndovu Fund’s low minimum investment requirement makes it a viable option for individuals who have been hesitant to invest due to financial constraints, thereby fostering a culture of saving and investing among Kenyans.

As Ndovu continues to innovate and expand its offerings, it is poised to make a lasting impact on Kenya’s investment culture, empowering more individuals to participate in wealth-building opportunities.

You can download the Ndovu app HERE.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke