LOOP App New UI – Same LOOP, Better Experience

LOOP App New UI: If you’re a LOOP user you have probably noticed that the app has taken a significant step forward by introducing a brand-new user interface (UI), designed to enhance the digital banking experience.

While the look and feel have been revamped, it’s important to note that the core functionalities that users have grown to love and use remain intact. According to LOOP, the redesign aims to offer a more intuitive, seamless, and personalized experience, ensuring that banking with LOOP continues to align with your lifestyle.

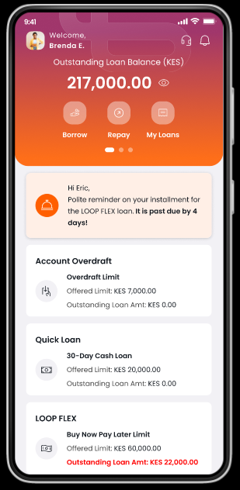

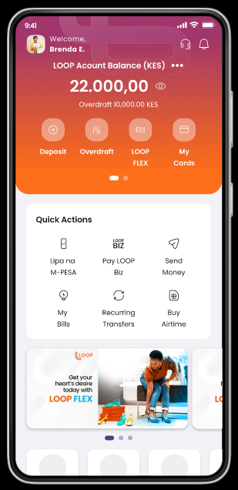

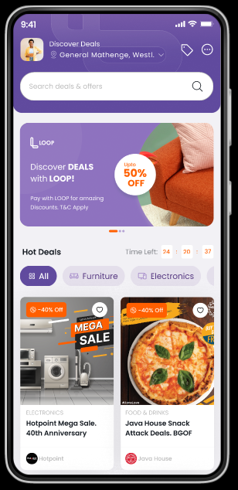

A Fresh Look with Improved Navigation

One of the first things users will notice is the fresh and modern design of the LOOP app. The new UI is sleek, visually appealing, and optimized for easy navigation. Key banking functions are now more accessible, reducing the number of steps needed to complete transactions. Whether checking balances, transferring money, or managing finances, users will find the new design more user-friendly and efficient.

The updated UI retains the same color scheme though but with improved typography, enhancing readability and making the app more engaging. The layout has been rearranged to provide a cleaner and less cluttered interface, ensuring users can access what they need quickly and without confusion.

Seamless Transactions with Fewer Steps

Understanding the need for efficiency in today’s fast-paced world, the new LOOP UI ensures that transactions are quicker and require fewer steps. Users can enjoy a frictionless experience when sending money, making payments, and managing their finances. The app continues to support essential financial functions, including:

- Instant Money Transfers – Easily send money to other LOOP users or external bank accounts.

- Bill Payments – Pay for utilities, internet, and other services without hassle.

- Airtime purchase – A seamless way to buy airtime for different providers..

- Mobile Money Integration – Effortlessly Transfer funds between LOOP and mobile money services effortlessly.

- Card management including linking cards among other features.

These features are now presented in a more streamlined way, ensuring that users spend less time navigating the app and more time managing their finances efficiently.

Banking Experience Personalized

The new UI presents a greater degree of personalization, adapting to individual user habits. The dashboard now has frequently used features. LOOP’s smart financial management tools which we have all come to like remain at the core of the experience, helping users to:

- Track their expenses with detailed spending insights.

- Set savings goals and monitor progress at the same time and also.

- Manage loans and overdrafts conveniently.

This personalized approach ensures that every LOOP user gets a banking experience tailored to their financial habits and goals.

Same LOOP app, now more intuitive

The app’s design might have changed, but LOOP continues to deliver the same feature-rich banking experience we are all used to. Existing users will see that all the things they liked before are still there, but now shown in a simpler and faster way.

For existing users, switching to the new LOOP app experience is simple, just update the app to the latest version and explore the refreshed design and improved functionalities. New users can download the app, register, and start enjoying the benefits of a digital-first banking experience tailored for convenience and efficiency.

The LOOP app is available for download for Android devices on the PlayStore and IOS devices on the Apple Store.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke