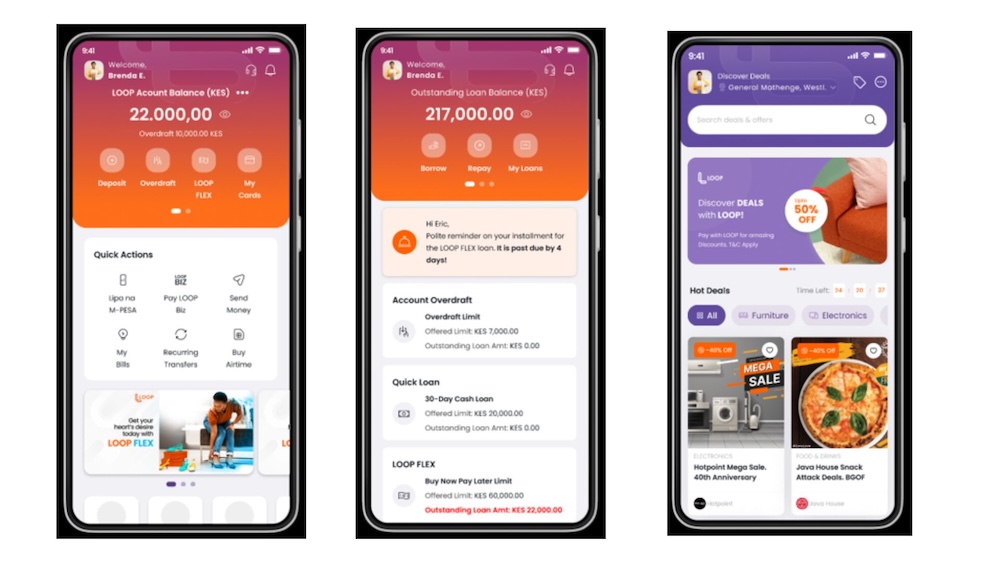

LOOP App: A Fresh, Intuitive Experience

In an era where digital banking is changing how Kenyans interact with their money, LOOP app has taken a big leap ahead with an improved user interface (UI).

The update was rolled out to users in February to bring them a better, quicker, and easier experience, made to fit right into today’s way of living. With simple steps and better access, the new LOOP UI makes sure that LOOP users can handle their money needs with no stress.

A Refreshed Look and Feel

The new LOOP UI is freshly and modernly designed. It carries minor adjustments refined to provide an attractive visual experience and keep up with modern digital aesthetics. Updated color schemes, fluid transitions, and clear typography have taken user experience interaction to a different level. All in the spirit of making the clarity and ease of use better so that there is no friction for the user with their tasks on managing their finances.

Intuitive Navigation for Effortless Access

Improved navigation stands out as one of the features in the new LOOP app. Menus and options have been carefully redone to ensure that the user experience is much more streamlined. Rather than the somewhat complex tabs and drop-downs that were in place before, customers can now have fewer taps to access key features which in turn make their daily financial tasks more efficient.

Seamless Transaction Experience

One of the biggest improvements in the new UI is the transaction experience. Be it moving cash between accounts, paying for things, or handling bills – steps are much lower now and it’s faster and smoother for the user. Less steps with a more stylish design for users needing quick actions makes it better͏.

The app also gives you instant updates on your spending and sends alerts, keeping you in the loop on your money. Of course, safety is key, so there are enhanced authentication measures to protect user data without compromising convenience.

A Lifestyle-Driven Approach

LOOP is more than just a banking app – it is a financial management tool designed to help you take control of your money. Besides banking, the LOOP app knows that money is important for how a person lives. The new UI puts together easy-to-use features for life, such as tools for setting goals, wise saving ways, and alerts that can be changed.

For users who make a lot of digital payments, LOOP has made this even easier and without any friction. From paying for subscriptions to making e-commerce transactions, with LOOP, all interactions are quick and safe.

Why This Matters

A move toward a more intuitive and user-friendly interface speaks volumes about what LOOP views as a priority: improving the customer journey. Digital banking shouldn’t be complicated; digital banking should be easy, safe, and built for today.

In the fast, easy, and smooth way, the new LOOP UI shows what will come to digital banking. It is more than looks; it is about making money management a joint part of daily life.

The new LOOP app UI comes as a game-changer in the arena of digital banking. It puts into place features by setting a priority for ease of access along with financial insights; hence, creating a new way through which users relate to their money. Bills can be paid; savings can be managed, and spending is tracked on a beautiful and simple-to-understand platform.

For anyone in search of a banking app that matches how they live, the new LOOP UI is that much-welcomed improvement providing elegance plus utility.

The LOOP app is available for download for Android devices on the PlayStore and IOS devices on the Apple Store.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke