Paga’s American Bet: Can a Nigerian Fintech Outmaneuver U.S. Banks in the Diaspora Remittance Race?

A Nigerian fintech with street-level credibility is crashing America’s polished neobank party — betting that real trust beats glossy features.

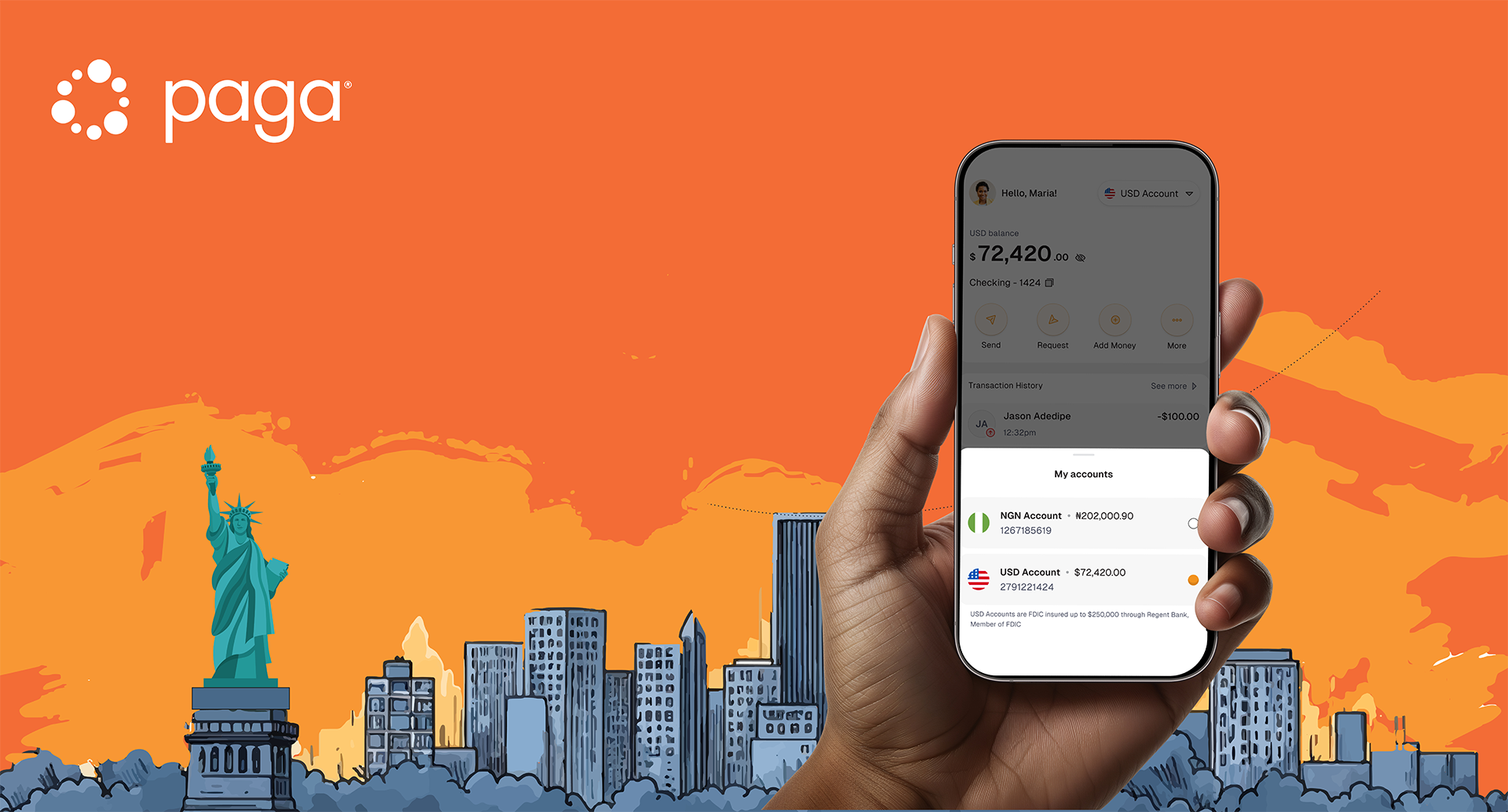

Most fintechs entering the United States start by promising convenience. Paga is staking its entry on something deeper: familiarity. After 15 years operating across Nigeria’s notoriously fragmented payment rails, the company believes that hard-won muscle memory gives it an edge over America’s slickest neobanks.

The pitch is deceptively simple: a fully insured U.S. checking account, available on iOS and Android wallets, but optimized for people who wake up in Atlanta and send money to Ibadan before breakfast. That dual loyalty — American infrastructure on one end, African realities on the other — is something U.S. incumbents have never managed to reconcile. They treat remittances like an add-on. Paga treats them as the core operating system.

Whether that framing holds is about to be tested in the most politically tense environment possible.

Remittances Are Not a Perk — They’re a Survival Mechanism

For African migrants, sending money home isn’t an optional courtesy. It’s a recurring obligation, closer to a tax than a financial service. Yet the companies tasked with facilitating this responsibility often treat it like a customer loyalty perk, tucked among cashback offers and “coming soon” features.

Paga reads the behavior differently. Its product is built with urgency in mind — not just low fees but predictable settlement, access to local agents when digital rails fail, and built-in methods for beneficiaries who may not use bank apps at all. It’s infrastructure for people who have to send money now, not whenever the ACH network decides funds can clear.

Meanwhile, the Trump administration is set to impose a 1% levy on outbound U.S. remittances starting in January 2026. That could turn low-margin transfers into a minefield. Instead of stalling, Paga is walking straight into the policy storm — apparently betting that a tax won’t change behavior nearly as much as irritants like transfer delays and failed deliveries already do.

Competitors Are Everywhere — But None Are Playing the Same Game

Paga isn’t alone. LemFi and Kredete have raised millions to build remittance-first digital banks. Flutterwave, Moniepoint, and Kuda all want to be the default checkout layer for Africa’s global citizens. On the surface, this looks like a uniform land grab.

Scratch at the strategies, though, and differences emerge. LemFi operates like a fast-moving lifestyle wallet. Kuda leans on sleek design and a youth pitch. Flutterwave wants to be PayPal for Africa. Paga is positioning itself as the Remittance Department of Real Life — grounded, slightly unglamorous, but fluent in how Africans actually move money.

The real competition may not be African at all. Chime, SoFi, Revolut, and Cash App aren’t explicitly building for immigrants, but they already control the digital banking relationships through which most remittances begin. If Paga can’t replace those accounts, it needs to behave like plumbing — invisible but indispensable.

Immigration Policy Could Be a Tailwind — or a Catastrophe

Launching a product for immigrants during an explicitly anti-immigrant policy cycle is either reckless or genius. It depends on how one interprets U.S. politics.

There are two plausible futures. In one, tougher border rhetoric spills into banking regulation, leading to enhanced monitoring of cross-border transfers and high-friction onboarding requirements. In that reality, Paga faces a compliance ceiling before it gains scale.

In the more likely scenario, rhetoric stays loud but quietly sidesteps financial inclusion — if only because restricting remittance channels would enrage both migrant communities and their governments abroad. Politicians like to criticize money flows more than they like interrupting them.

Paga seems to be betting on the latter. If correct, it will own a corridor others were too cautious to enter.

The Final Constraint: Trust

The only real moat in diaspora banking isn’t licensing or UX. It’s emotional credibility. Africans abroad routinely test fintech apps with tiny amounts — $20, maybe $50 — and wait to see if their mother confirms receipt. If that goes wrong even once, no amount of venture capital can engineer forgiveness.

Paga’s advantage is that many of those mothers already know the brand. It operates through street kiosks and mobile agents back home — not a faceless logo on a billboard. That ambient familiarity could prove priceless.

Still, operating in the U.S. means resetting expectations. Customer support that responds in two days won’t cut it. Transfer delays will be read not as “network error” but “another platform I shouldn’t have trusted.”

If Paga really wants to own the diaspora, it won’t just need to be better than U.S. banks at wiring money abroad. It will need to behave like the relative who always picks up the phone.

Go to TECHTRENDSKE.co.ke for more tech and business news from the African continent.

Mark your calendars! The GreenShift Sustainability Forum is back in Nairobi this November. Join innovators, policymakers & sustainability leaders for a breakfast forum as we explore sustainable solutions shaping the continent’s future. Limited slots – Register now – here. Email info@techtrendsmedia.co.ke for partnership requests.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke