Kenya rolls out a QR code standard for facilitating digital payments

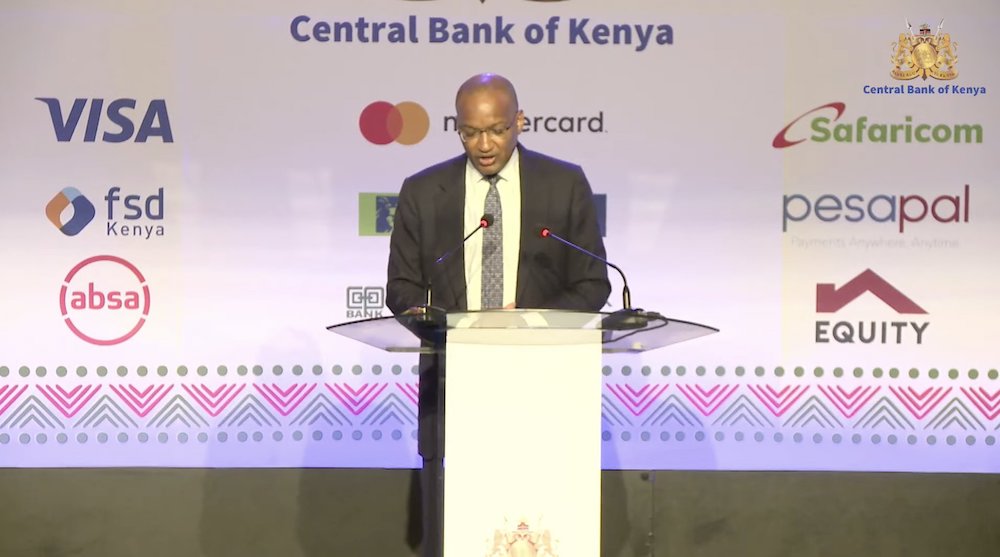

The Central Bank of Kenya (CBK) on Wednesday unveiled the Kenya Quick Response (QR) Code Standard 2023.

The QR code standard was launched in partnership with Payment Service Providers, banks, card schemes, among others. They include Safaricom, Equity Bank, ABSA, KCB, Co-operative Bank, Visa, Mastercard, PesaPal, and FSD Kenya.

CBK says the Standard will guide how Payment Service Providers and banks (institutions) that are regulated by the CBK will issue QR Codes to consumers and businesses that accept digital payments.

QR Codes are machine-readable code consisting of an array of black and white squares containing information that provide an alternative option for initiating and accepting digital payments. CBK says in a statement that the implementation of the Standard, and use of standardised QR Code-enabled payments, will bring practical benefits to businesses and customers.

‘’Customers will now be able to make digital payments in an easy, fast, convenient, and secure manner using QR. Previously, customers had to manually input different payment codes and numbers, hence creating friction and cumbersome payment processes that are prone to errors.’’ the statement reads.

The Standard will also promote inclusion by enabling institutions of various sizes and customer focus to increase adoption digital payments. ’’ In the long-term, use of standardised QR Codes will facilitate launch of innovative products and deepen the benefits already enjoyed by customers making payments across various institutions and mobile money networks (interoperability)’’ the statement further says.

The issuance of the Standard marks an important step in the implementation of the National Payments Strategy 2022 – 2025 developed by CBK. Launched in 2022, the strategy provides a framework to guide the current and future of payment services.

Kenya now joins other leading markets that have implemented the standardized approach to issuing QR codes for facilitating payments. These countries include the Philippines, Jordan, South Africa, Singapore, Bahrain, Saudi Arabia, India, and China.

The Standard will be rolled out in a phased approach as participating players align their operations to the requirements set out in the Standard and increase customer awareness.

Follow us on Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to info@techtrendske.co.ke