Kenyans Deposited Nearly Ksh.607B Via Mobile Money In Q2 2019/2020, Report

Mobile money usage in Kenya has continued to grow in the country tied to its convenience. Using the platforms, you can pay for any service and even buy anything from anywhere in the country. But how much are people transacting on mobile platforms in Kenya? The latest report from the Communications Authority of Kenya holds answers to that.

In its Sector Statistics report, the CAK shows that mobile money usage in the country has continued to rise in Q2 2019/2020 – the period between October and December 2019.

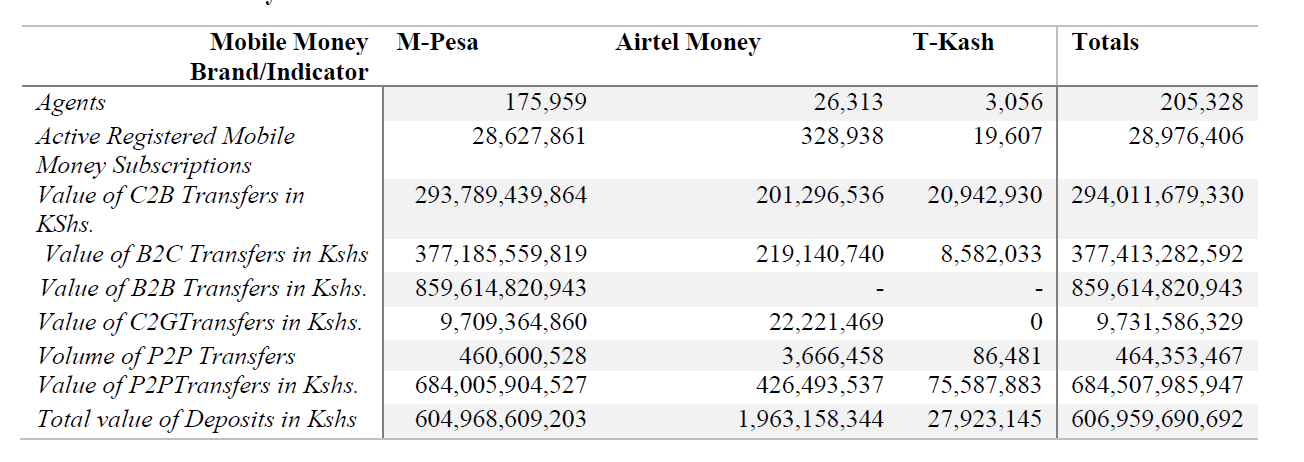

In the period, the number of active registered mobile money subscriptions in the country stood at 28.9 million, according to CAK, while the number of active agents was 205,328.

Safaricom’s, M-Pesa, continued its dominance; controlling 98.8 percent of the market. Airtel Money ranks second while Telkom Kenya’s T-Kash trails behind holding a minute 0.07 percent market share.

During the period under review, the value of Customers to Businesses (C2B) transactions performed via Mobile money platforms surpassed Ksh 294bn, while the value of person to person (P2P) transfers was slightly over Ksh 684 billion, up from Ksh 665 in the previous quarter. B2B transactions surpassed Ksh 859bn, solely on M-Pesa.

The total value of deposits across M-Pesa, Airtel Money and T-Kash was nearly Ksh 607 billion throughout the three months. The value of deposits still grew in the period, moving up by over Ksh 2.7billion, from a total of over 604 billion in the previous quarter.

CAK says the “use of mobile money platform for payment of bills has evolved over the quarters prompting the Authority to collect and report on more disaggregated data with an aim of obtaining further insights.”

N/B: 1. The Authority noted in its report that Mobile Pay Ltd data wasn’t available “due to non-compliance of the operator.”

2. Equitel money service wasn’t included as it is considered as a mobile banking service rather than a mobile wallet service.

Follow us on Telegram, Twitter, Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates.

One Comment