Why Wechat is a threat to Safaricom’s M-Pesa.

A few days ago I visited Chinese internet finance museum for a blockchain event organized by okcoin, one of Bitcoin’s large players. The 3 giants in Chinese internet: Baidu, Alibaba and Tencent occupied the most entries with their products and their subsidiaries numbering around 20 companies for each(photo below). The event area was in a large dimly lit conference room with large Hogwarts like posters hanging from the wall of the well-known internet finance visionaries such PayPal founder, Peter Thiel, Tranferswise’s Taavet Hinrikus, lending club’s Renaud Laplanche. Ensconced between them was Michael Joseph, the former CEO of Safaricom who oversaw the launch and runaway success of Safaricom’s money transfer service, M-Pesa.

M-Pesa completely altered everyday lives of most Kenyans, it was breath of fresh air. Before Safaricom, Banks ruled the Kenya finance market with an iron hand, applying for a bank account was tedious, with stiff-faced and sullen bank tellers behind a few inches thick glass making the experience even more depressing. They charged exorbitant interest rates, had very few ATMs mostly in high-end areas in the capital city, offered terrible services and being extremely choosy on who to bank. They kept finding better ways of extorting the consumers such as paying to get a statement among other illogical charges.

After M-Pesa, your lovely neighbor became your bank teller. You no longer needed a long line to deposit money or withdraw money, as you could just go to your neighbor’s house or call them. There had been various bank collapses and massive corruption scandals involving banks which led to any contact with a bank being only when needed. Kenyans had developed a deep mistrust in the banking system which resulted in created their own mini banks called Saccos or merry go rounds. Mpesa transformed this terrible experience and also affected other parts of the economy such increasing employment opportunists and creating a finance institution that has had a very significant effect on economic growth and the GDP. The Mpesa technology is now being licensed in other countries and recently it was introduced into Albania.

This might all change once again if Wechat realizes its ambitions of going international.

Africa plays an important role in its expansion due to similar characteristics with its home market such as a relatively new finance system (Compared to the Western ones). New users are skipping the PC era altogether into the mobile era just as majority African countries. The African banking system is also not as regulated as the Western banking systems and few if any alternatives exist. Wechat is owned by Tencent, which is in turn partly owned the uncelebrated South Africa’s tech giant, Naspers. South Africa is therefore Wechat first port of call and after it’s launch in South Africa, Kenya will be its next market as is usually the case of most companies which come to Africa due to South Africa, Kenya, and Nigeria, being the regional economic heavyweights. Wechat threat to M-Pesa dominance is imminent.

Safaricom has never had to worry about Mpesa dominance. Numerous attempts by other telcos (Orange, a French multinational, Airtel an Indian multinational), banks, startups with better technology and cheaper fees tried and failed terribly. Safaricom enjoys a first-to-market advantage, a large network of Mpesa shops, a majority of the subscribers for its carrier business.

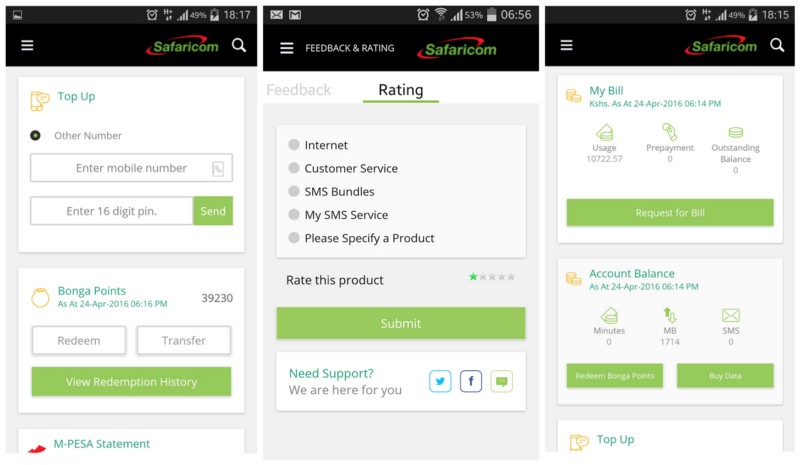

Safaricom has, therefore, become lazy and un-innovative, concentrating more on milking its cash cow. Mpesa which will be 10 years this year. Despite a yearly revenue of $320 million (2015) and 13 million users, user-facing it still lacks a mobile app and no user-facing website. Safaricom licenses the mpesa technology from its major shareholder, Vodaphone and pays 12% of the mpesa revenues as license fees. This is transfer payments and therefore subject to only withholding tax. This lack of control of the mpesa platform is also major reason Safaricom cannot easily innovate. Mpesa has not been as successful in some other markets as it was launched without major revisions. Vodacom (which Vodafone has 65% ownership), the leading telco in South Africa tried and failed numerous times to launch the Mpesa service in South Africa. It finally gave up and will reportedly no longer try to launch Mpesa in South Africa.

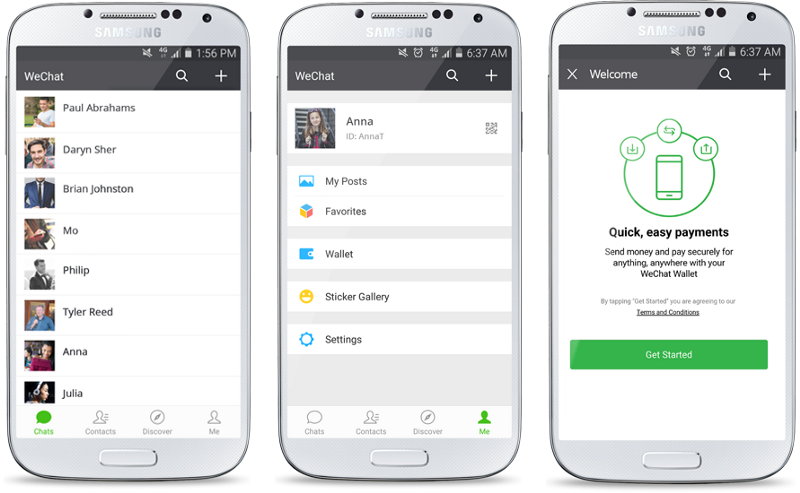

Wechat has been locked in a battle for supremacy with Alibaba-owned Alipay. Both companies have been improving their respective money banking apps by copying each other and other popular apps either in China or outside such as the read and burn feature in Alipay, which is a copy of Snapchat. Wechat appears to be winning from my everyday experience, with nearly everyone now using Wechat wallet as compared to Alipay. Wechat wallet is far much younger as compared to Alipay which was released nearly 13 years ago compared to Wechat wallet which was launched in 2014. Wechat is virtually unknown outside Asia, but its features are been copied by western companies such Linkedin account QR codes and facebook focus on its messenger platform among many others.

Wechat which is now being referred to as super app is soon expanding worldwide, since it has already conquered its home market. The reigning mantra in the Chinese economy is execution over first to market or other perceived advantages. It recently debuted it mini-programs, a direct assault of the google and apple app stores. Its official accounts are similar to facebook pages but as powerful a native apps. Some companies have built billion dollar businesses inside wechat official accounts such as weidian (small shop)a Shopify clone, Weipiao (small ticket)movie tickets,ele.me (meal ordering) among many others. It managed to educate a billion people on how to use QR codes, a technology that was rarely used before the launch of wechat. Wechat’s hongbao (red pocket) feature was a brilliant stroke of innovative execution that grew the subscriber base of its wallet feature exponentially. Wechat began its international expansion by accepting non-Chinese cards such Mastercard and Visa to be linked with the wallet.

Wechat wallet has already been launched in South Africa. Expansion into East Africa poses a threat not only to M-Pesa but to Safaricom due to Wechat’s other innovative features which have even been copied by Facebook. Wechat wallet has been free since it’s launch as Tencent used its vast sums of cash to run it, making only marginal revenue mostly from selling message stickers until it grew to nearly a billion users. It is free to transfer money between accounts and pay for items while Safaricom charges an exorbitant fee. Paying for items in Mpesa is a very frustrating experience and usually done due to lack of options.

Wechat wallet relies on connecting a user’s bank account to his wechat account which is a huge opportunity for some Kenyan banks if they partner with wechat. Due to the fact that wechat launched in South Africa with Standard bank, Wechat will probably launch in Kenya with Standard’s Kenyan subsidiary Stanbic Bank which is one of the top five banks by assets and the sponsor of the very popular Nairobi marathon.

Wechat wallet launch in Kenya will likely be followed by attempts by banks and Safaricom ganging up. This will be a repeat of a similar situation when banks ganged up against Safaricom after the launch of Mpesa and used various tactics such as court cases and lobbying to stop the spread on Mpesa. Safaricom too is prone to this tactics as evidenced when its cut bitpesa, a blockchain startup, from its Mpesa platform. Tencent, and it’s app Wechat have perfected these tactics too as anticompetitive laws rarely exist or are not enforced in China. Wechat blocked Uber’s official account as it had invested in Uber’s rival Didi dache. This and other tactics ultimately led Uber to pull out of China, the only market it has given up on. Tencent is also an investor in Xiaomi, another scrappy startup that managed to become the World top five smartphone seller in than 5 years.

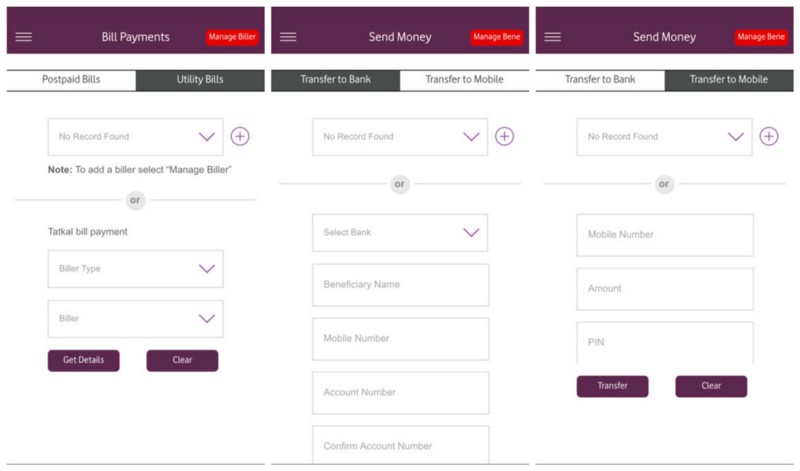

Vodaphone, Safaricom’s majority shareholder and also Mpesa patent holder has launched a Mpesa mobile app in other regions in which it operates such as India, Romania, but the app appears to be mediocre compared to Wechat. It requires manual filling of data which the user has to remember such as the till number, bank account number and numerous other steps to complete a simple transaction. Wechat wallet requires you only have to enter the amount and password to complete the transaction.

The success of Wechat will also affect Vodaphone as it gets a significant revenue from licensing the Mpesa technology as companies will now prefer building their own mobile apps. Wechat too has made some missteps such hiring footballer Lionel Messi in 2014 to for its worldwide expansion. This did not have any effect its adoption and was considered a failure. It tried launching in India too but Whatsapp had already become far too commonly used. Similar attempts in Thailand, Indonesia, and Malaysia were met with strong competition from other mobile messaging apps such as Kik and Line. (Tencent is an investor in kik messenger).

A competition between Wechat and Mpesa will also spark historical rivalries between English and Afrikaan companies (Vodaphone and Naspers), and Western and Chinese companies. In Kenya, this is reminiscent of the stiff competition faced by Sabmiller entry into East Africa, which was the home market of another English multinational Diageo (EABL ).

There have been reports of Safaricom’s intention to split the business into Mpesa and Safaricom which is similar to the split off PayPal and eBay. This might be the only hope for Mpesa to chart its own path and face the vicious battle that will be coming very soon.

This article was written by Fabian L and was originally published on Medium.