Mobile Money Market Continues to Grow in Kenya, M-Pesa Nears 99 percent Market Share

The Kenya n mobile money market plays a fundamental role in the country’s mission to financial inclusion.

The market has been growing and still is according to the latest Sector Statistics report from the Communications Authority of Kenya.

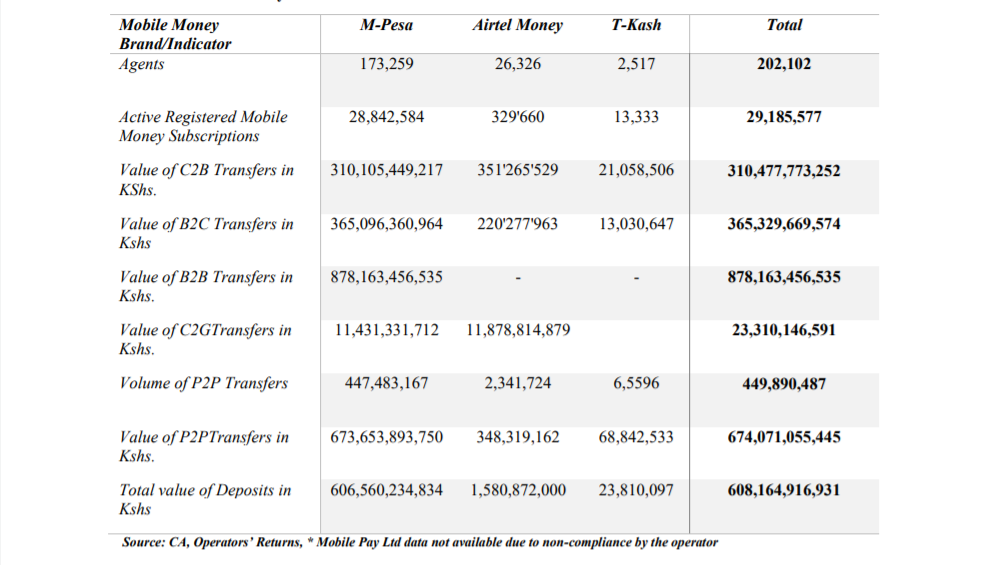

Under the third quarter of the FY 2019/20 (Jan-March 2020), the number of registered active mobile money subscriptions in Kenya stood at 29.1 million. An increase from 28.9 million registered in the period ended December 2019.

As usual, M-Pesa continues to lead the market, currently holding a 98.8 percent market share, the same as the previous quarter. Telkom’s T-Kash dwindled with market share dropping by 0.02, from 0.07 previously to 0.05.

-

Read >>24Bit Podcast Episode 18: Mobile Money and Mobile Banking Transaction Rates in Kenya

- Read>>Africa mobile money market to reach $1 billion by 2024, report

- Read >>Kenyans Deposited Nearly Ksh.607B Via Mobile Money In Q2 2019/2020, Report

On the other hand, Airtel Money ranked second with a 1.1 percent market share. Interestingly, the number of mobile money agents across the three providers dropped to 202,102 from 205,328 in Q2.

The value of peer-to-peer transfers dropped from Ksh 684.5 billion to Ksh 674.1 billion. The volume of P2P transfers declined as well in the quarter. Kenyans sent Ksh 310 billion to businesses in the 3-month period, up by around Ksh 6billion from the previous quarter.

The number of deposits increased as well by around Ksh 1billion.

Here’s an overview of Customers to Businesses (C2B), Business to Customer (B2C), Business to Business (B2B), Customer to Government (C2G), Person to Person (P2P) transfers and total deposits per mobile money brand.

Follow us on Telegram, Twitter, Facebook or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates.