For years, the forex market in Kenya was akin to the Wild West. Stories of overnight millionaires clashed with devastating tales of traders losing their life savings to offshore scammers who vanished into the digital ether.

However, a significant shift is currently reshaping the financial landscape. The rigorous licensing framework enforced by the Capital Markets Authority (CMA) has begun to instill a newfound sense of confidence among Kenyan traders, effectively bringing a once-opaque industry into the light of regulatory safety.

The turning point came with the introduction of the Capital Markets (Online Foreign Exchange Trading) Regulations in 2017. Before this legal infrastructure, Kenyans desperate to access the global currency markets were forced to rely on unregulated foreign brokers. These entities often operated with no physical presence in the country, leaving local investors with zero legal recourse if funds went missing.

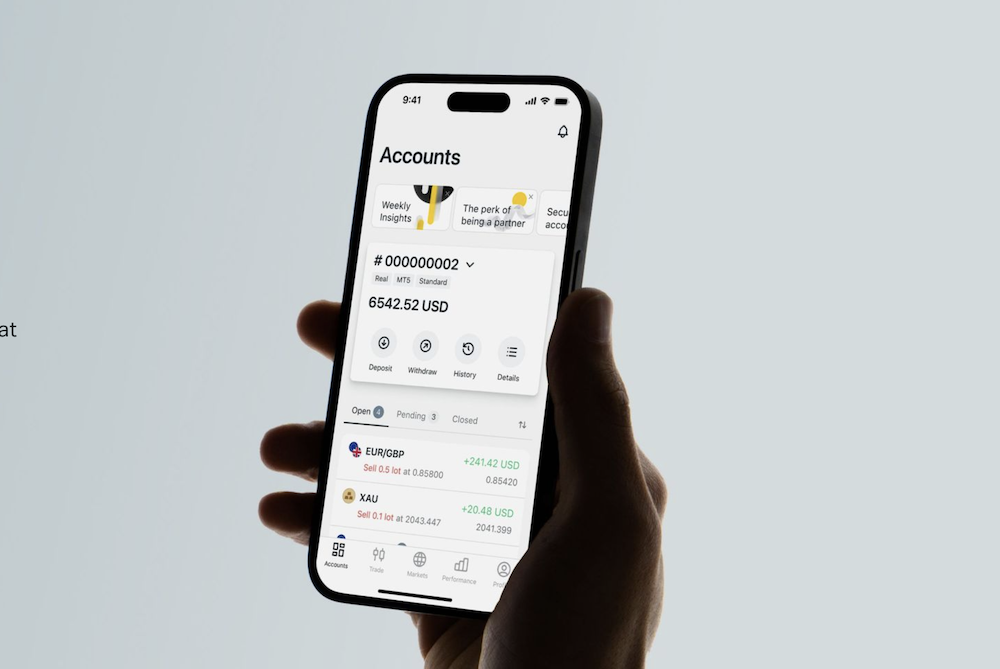

Today, the narrative is different. The CMA has successfully licensed a growing roster of non-dealing online forex brokers, including major players like Exness, EGM Securities (trading as FXPesa), Pepperstone Markets Kenya, and Scope Markets, among others. This move has not only legitimized the industry but has also spurred a massive migration of traders from the shadows of the black market to the safety of regulated platforms.

“Licensing changes the psychology of a market. It shifts forex trading from a risky fringe activity into a legitimate financial avenue. In Kenya, that shift is now visible in the data: higher volume, more active traders, and a broader culture of responsibility. Regulation brings discipline, and discipline is what allows markets to grow safely,” Paul Margarites, Exness Regional Commercial Director, comments.

Investor confidence is primarily being driven by the tangible protections that come with a CMA license. Unlike unregulated entities, licensed brokers are mandated to keep client funds in segregated accounts, separate from their own operational capital. This ensures that if a brokerage faces financial difficulties, traders’ money remains secure. Furthermore, the requirement for these brokers to maintain a physical office in Kenya, has been a game-changer. For the average trader, the ability to walk into a local office and speak to a representative in person builds a level of trust that a faceless website simply cannot match.

This regulatory clarity has unlocked a surge in participation. Industry data indicates that since the regulations took full effect, trading volumes in the regulated space have jumped by over 80 percent. The number of active retail traders has swelled significantly, with estimates suggesting the figure has long surpassed the 90,000 mark recorded in 2020. The ability to fund accounts using local payment channels like M-Pesa and local bank transfers has further greased the wheels of this growth. Traders no longer have to grapple with complex international wire transfers or expensive credit card fees, making the market accessible to a broader demographic of Kenyans, from seasoned investors to tech-savvy youth.

CMA Chief Executive Officer Wyckliffe Shamiah has frequently emphasized that this licensing drive is part of a broader strategy to deepen Kenya’s capital markets. By bringing forex trading under the regulatory umbrella, the authority is not just protecting investors but also integrating this liquidity into the formal economy. The regulator has remained active, issuing new licenses throughout 2024 and 2025 to diversify the ecosystem, ensuring competition leads to better services and lower costs for the Kenyan trader.

As Kenya cements its status as the Silicon Savannah of East Africa, the forex sector stands as a testament to the power of smart regulation. The fear of “fly-by-night” brokers is gradually being replaced by a professional, transparent trading environment.

Go to TECHTRENDSKE.co.ke for more tech and business news from the African continent.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke