Kenya has the opportunity to become a continental leader in FinTech and dramatically boost financial inclusion by enhancing the existing ecosystem. This is according to a new research from TheCityUK and the Nairobi International Financial Centre (NIFC) developed by PwC.

Doing so, the report notes will take a renewed focus by the public and private sector to address barriers to entry and growth for startups, helping startups to access more capital and achieve scale, and adopting a cross-sector approach to FinTech regulation.

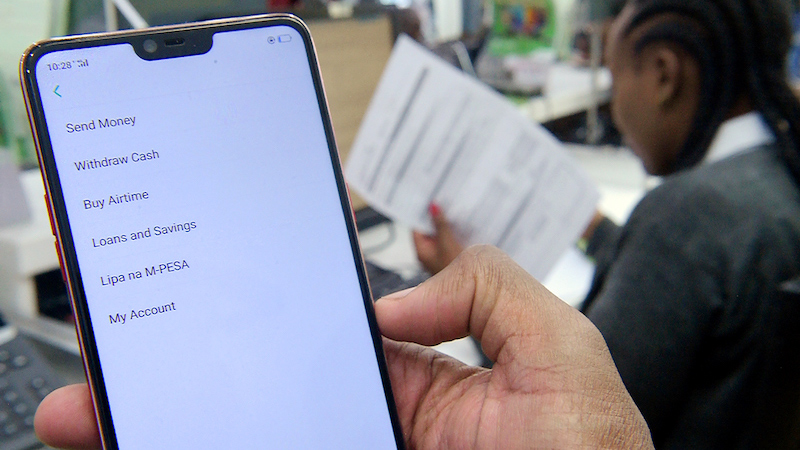

The research, set out in a report ‘FinTech in Kenya: Toward an enhanced policy and regulatory framework’, found that Kenya is already well-established as a leading source of FinTech innovation, developing solutions that are leapfrogging existing infrastructure and driving financial inclusion and the economic empowerment of its citizens. Formal financial inclusion in services and products in Kenya has grown significantly from 26.7% in 2006 to 83.7% in 2021 [2] – growth largely driven by new financial technology and innovations, especially in mobile money and mobile banking.

Digital financial products have played a significant role in catalysing financial development and inclusion across the country, especially because of the affordable and accessible services that have subsequently been layered onto the mobile and digital platforms infrastructure. Kenya’s efforts in the growth of FinTech can be seen through its forward-thinking financial inclusion strategies and incentivising schemes such as the phased enactment of dedicated payments and digital lending regulatory framework and the adoption of regulatory sandboxes. However, gaps and challenges still exist that impact the evaluation, approval and regulation of new and complex FinTech products and innovations.

In the report, TheCityUK and PwC make the case for a series of policy and regulatory enhancements which, if taken forward, could spur greater innovation, unlock capital and investment, and further accelerate financial inclusion.

“FinTech is changing the nature of financial services globally. It has made itself a key driver of economic development by speeding up financial inclusion and introducing innovative financial products at a rapid rate. While Kenya is a leader in the FinTech world, increased impact can be achieved by allowing greater innovation and attracting more investment into Fintech. A supportive regulatory framework is key in attracting more players into the market, setting the stage for increased innovation in the sector.” Joseph Githaiga, Associate Director, PwC Kenya, said.

Glynn Austen-Brown, Partner, PwC UK, said the progress made in digital innovation worldwide calls for countries to recognise the evolution of financial services offerings. ”Kenya’s efforts in the growth of FinTech can be seen through its forward-thinking financial inclusion strategies and incentivising schemes such as regulatory sandboxes. However, the gaps and the challenges that FinTech players face can serve to blunt the many positives present in the Kenyan fintech ecosystem. Addressing these challenges will allow Kenya to continue to be at the forefront of technology innovation and developments and provide an enabling environment for such innovations to scale in Africa.”

The report makes a series of recommendations for policymakers to consider. For Short term priorities, the report is recommending the establishment of a finTech provider facing one stop shop or FinTech office with staff representation from the relevant regulators. It is also recommending the creation of a consolidated FinTech sandbox reducing lead times for approvals by allowing regulators to jointly monitor business models with multiple sub-sector elements as well as encouraging more collaboration amongst FinTech providers, regulators, and stakeholders using existing forums to create a coordinated Kenya FinTech policy roadmap.

Furthermore, it is recommending that policymakers should build a framework to continuously identify and prioritise FinTech regulation training needs and Explore mechanisms to bridge training gaps.

The report notes that longer-term success will depend on wider regulatory reform, with regulators coordinating their efforts to develop a FinTech policy and establish a well-coordinated national FinTech regulatory framework. The FinTech policy and regulatory interventions it says should aim to create certainty, maintain a balance between innovation and risk to the public and draw venture capital investment to sustain the budding FinTech sector in Kenya.

Deepen existing collaborative efforts between regulatory agencies in Kenya and peer regulators in other jurisdictions the report says will also ease cross-border FinTech operations.

“Nairobi has potential to be a leading financial services centre in Africa, and to realise this vision, we must strive to be at the forefront of future-focused growth areas like FinTech. Ensuring that our business environment keeps pace with the industry will help ensure we achieve the sustainable growth we need, benefiting our local and regional economy.” Oscar Njuguna, Acting CEO, Nairobi International Financial Centre (NIFC), said.

Scott Devine, Head Middle East and Africa, TheCityUK, noted that there is a rapidly developing global market for FinTech, data and technology, and this presents real opportunities for those countries in a position to capitalise. ”Kenya stands out as one of the world leaders in mobile money and is home to some of the best-known examples of FinTech-based financial inclusion. Now is the time to build on this strong foundation with government and regulators working closely with FinTech providers in developing policy and regulation that positively shapes the sector and lowers market barriers.”

Ultimately, Kenya should aim to develop a national FinTech policy framework that supports FinTech transformation and innovation, promotes industry growth and removes duplicative regulations in financial services to create certainty in FinTech services and products. The main objective of this policy should be financial inclusion and to establish incentives for FinTech entities by improving their ease of doing business.

Follow us on Telegram, Twitter, Facebook, TechTrends Podcast or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to info@techtrendske.co.ke