Five years since the inception of Samsung Pay, a mobile payments platform, the South Korean tech giant wants to move a bit closer to your financial life.

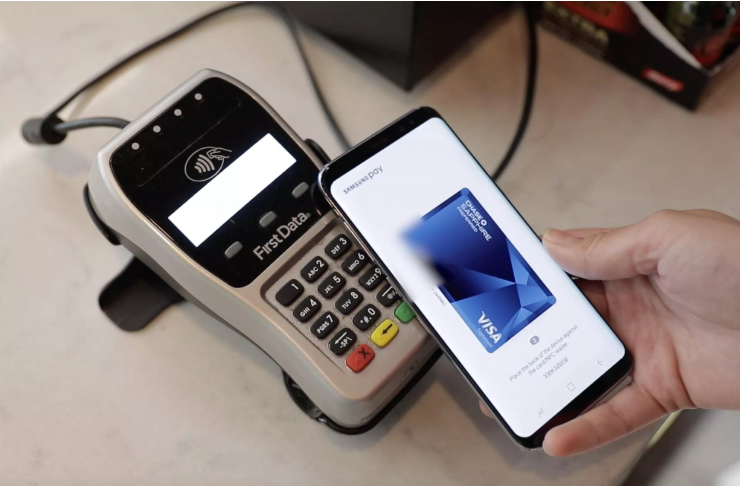

Samsung Pay enabled users in select regions to pay and, at the same time, earn rewards that can be redeemed at various online merchants. Its NFC support for Tap&Pay functionality strengthened the payment platform.

But on top of this, Samsung wants Pay also to become a “rewarding way to manage money.”

The bigger picture is to provide a mobile-first money management platform. The first step will involve the introduction of a debit card in North America backed by a cash management account in partnership with SoFi, a personal finance company.

“Our vision is to help consumers better manage their money so that they can achieve their dreams and goals,” said Sang Ahn, vice president and general manager of Samsung Pay, in a blog post.

Samsung will share more details on that in the coming few weeks, says Ahn.

By launching both a physical and virtual payment card, Samsung will join other tech giants who already have a similar offering. Apple has Apple Card, Huawei has Huawei Card, and Google is allegedly working on something as well, according to recent reports.

Last month, reports emerged, claiming that Google is working on its debit cards in partnership with some banks in the U.S.

In case you missed it, the Chinese tech giant, Huawei, unveiled its credit card last month called Huawei Card, both a physical and virtual card exclusively available in China.

Featured Image credits: Lexy Savvides/CNET

Follow us on Telegram, Twitter, Facebook, Instagram, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates.

One Comment