African finance leaders push for intra-continental investment reform at Nairobi conference

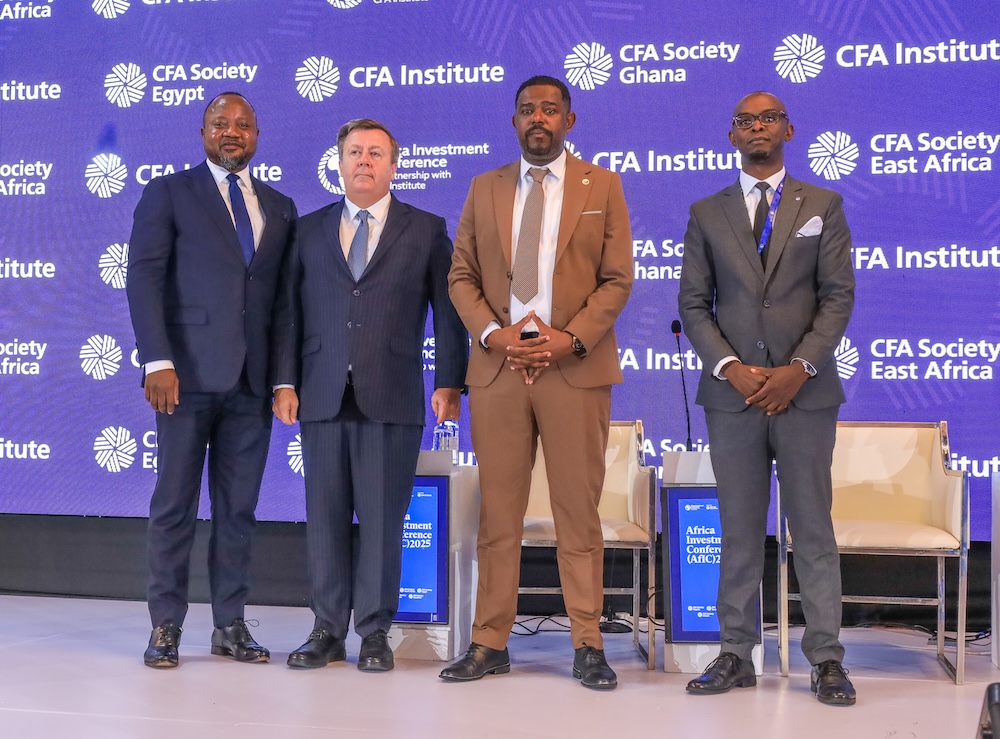

Top finance and policy leaders from across the continent have issued a collective call for accelerated cross-border investment frameworks and stronger capital market cooperation. The appeal was made in Nairobi on Wednesday during the official opening of the Africa Investment Conference (AfIC) 2025, a premier forum designed to reshape the continent’s economic landscape.

Hosted by the CFA Society East Africa under the theme “Africa Investing in Africa: Solutions to Challenges,” the conference convened at a pivotal moment. With shifting global economic dynamics and the urgent implementation of the African Continental Free Trade Area (AfCFTA), speakers emphasized that the continent can no longer rely solely on external funding.

The Chief Guest, Abubakar Hassan Abubakar, Principal Secretary at the State Department for Investment Promotion, delivered a powerful keynote address urging African nations to unlock capital within their own borders.

“Africa is at a turning point and for us to compete globally, we must unlock capital within our borders, accelerate the growth of both our private and public capital markets, and build deeper financial market linkages. AfIC 2025 provides the collaborative platform to move from ideas to coordinated action,” Mr. Abubakar stated.

He noted that with Africa’s demographic explosion and rapid urbanization, there is an increased appetite for infrastructure and technology investment. To meet this demand, he argued, nations must work together to mobilize domestic resources and streamline regulations to create predictable market environments.

“The Government of Kenya is committed to enhancing the country’s position as a gateway for investment into East Africa and across the continent. This includes improving the ease of doing business, strengthening investor protections, and supporting initiatives that unlock capital for enterprise growth, innovation, and sustainable development,” he added.

Francis Nasyomba, President of CFA Society East Africa, highlighted the conference’s role in promoting world-class professional standards and market integrity. He stressed that the event was designed to move beyond rhetoric.

“AfIC is designed to not only spark the conversations Africa urgently needs to have but to push for action. By bringing together policymakers, capital providers, and market practitioners, we are creating a foundation for stronger financial markets and better-aligned investment flows that drive shared prosperity,” said Mr. Nasyomba.

The discussions at the two-day event are centered around three interconnected themes critical to the continent’s financial health. First is the urgent need to dismantle long-standing barriers to intra-African capital flows, which continue to limit the movement of funds despite the ambitions of AfCFTA. Second, delegates are exploring African-designed models for scaling infrastructure and innovation that are tailored to local realities. Finally, the conference is focusing on strengthening strategic alliances among African financial markets to improve liquidity and investor confidence.

Mr. Nasyomba noted that these themes reflect the continent’s most pressing investment priorities. By bringing together government agencies, private sector players, and technology experts, the conference aims to forge partnerships that advance digital inclusion and facilitate long-term growth.

As the conference continues, stakeholders are expected to develop strategies that will help Africa leverage its young population and digital adoption rates to shape new investment frontiers, ensuring that economic growth is driven from within.

Go to TECHTRENDSKE.co.ke for more tech and business news from the African continent and across the world.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke