M-KOPA’s Loan Book in Kenya Surpasses KES 207 Billion

Fintech firm M-KOPA has revealed the substantial scale of its credit operations in Kenya, with its loan book unlocking over KES 207 billion in credit for traditionally unbanked individuals since 2010.

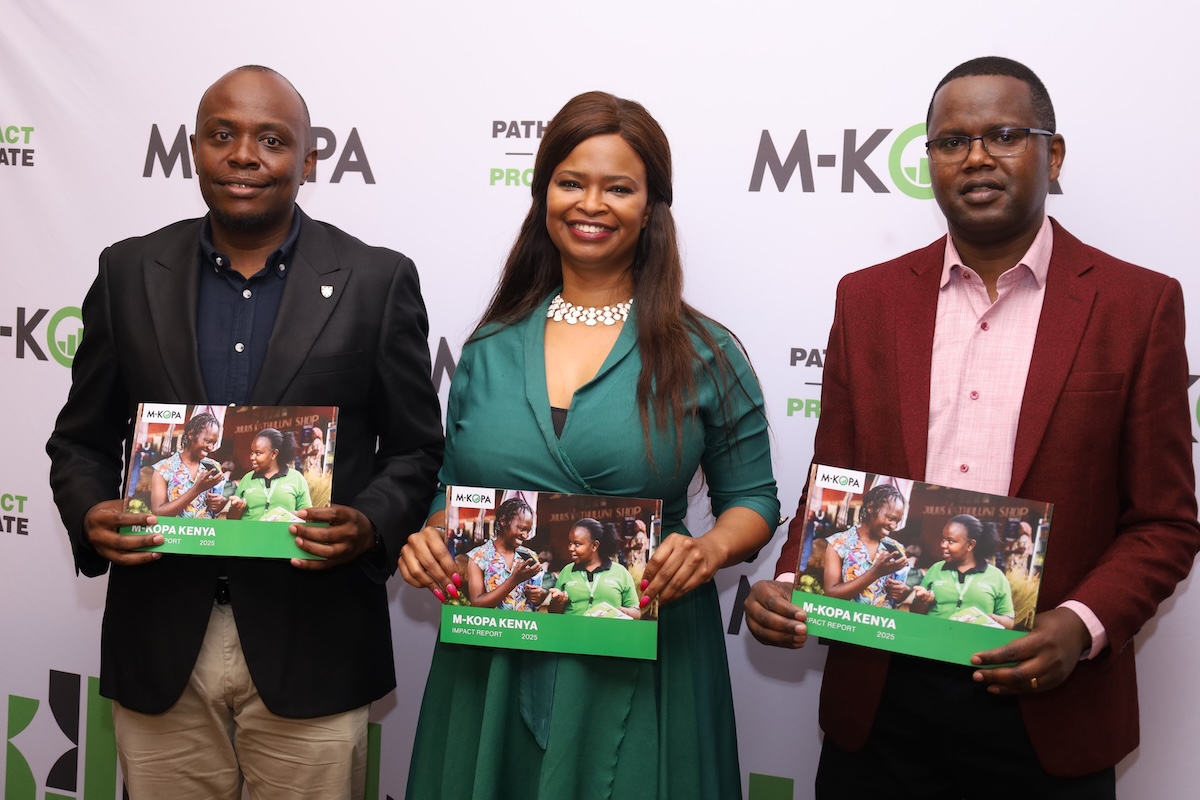

The figure is a key highlight in the company’s first Kenya-specific Impact Report, which details a decade of contribution to financial access, digital inclusion, and local economic growth.

M-KOPA Kenya has served a massive customer base of 4.8 million people who were previously excluded from formal finance. The company’s lending model, which uses flexible daily repayments, has provided access to income-generating assets like smartphones and, increasingly, electric motorbikes.

The sheer volume of credit unlocked directly correlates with customer empowerment. The majority of the KES 207 billion in credit has supported digital access, serving 4.5 million smartphone users, including 2.1 million first-time smartphone owners. The report highlights the purpose-driven nature of the loans: 67% of customers use their M-KOPA device for income generation, and 52% report earning more since joining the platform. For a significant segment of the population, M-KOPA is the entry point into formal credit, with 37% of customers accessing their first-ever formal loan through the platform.

Martin Kingori, General Manager, M-KOPA Kenya, emphasized the impact of responsible lending: “Our Impact Report demonstrates how inclusive financing, responsible lending, and digital innovation are transforming lives at scale… 9 out of 10 [Every Day Earners] report an improved quality of life, and more than half are now earning more.”

M-KOPA has successfully applied its flexible loan model to the growing e-mobility sector, financing over 5,000 electric motorbikes for Boda Boda riders. These riders, often excluded from traditional vehicle financing, are realizing significant benefits. Riders are saving an average of KES 730 per day on reduced fuel and repairs, and 66% of riders report higher earnings after switching to electric.

Brian Njao, General Manager – Mobility, noted the transferability of the loan model: “Reaching 5,000 electric motorbikes demonstrates how M-KOPA’s financing model works across asset classes. Whether it’s a smartphone or an e-motorbike, we’re solving the same challenge—making expensive, income-generating assets accessible to people earning day by day.”

In stark contrast to aggressive practices in the consumer finance sector, the report details M-KOPA’s commitment to consumer protection, ensuring its massive loan book is managed responsibly. 95% of customers state that the loan terms are fair, with no hidden fees or penalties for delayed payments. M-KOPA’s device-locking feature acts as an anti-debt mechanism. If a payment is missed, the device locks and skipped days are added to the term without penalty. Crucially, customers can return the device at any time for a full deposit refund with no further obligation, effectively preventing debt accumulation.

In addition to the vast credit unlocked, M-KOPA’s economic contributions include KES 3.79 billion in taxes contributed in 2024 and KES 20.3 billion in local procurement spend.

Go to TECHTRENDSKE.co.ke for more tech and business news from the African continent.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke