Why Kenya’s Banking Apps Have Become The Battleground For Everyday Access To Money

The formal institution of banking slipped entirely out of its marble halls and into ordinary people's pockets, dramatically changing not just who has access but what the feeling of financial control actually means.

Phones changed a habit and then a system. Over recent years the handset stopped being just a tool for calls or social updates. It became the main point of contact for many Kenyans who need to save, borrow or pay. Data and coverage helped, but so did choices made in boardrooms — which features to prioritise, how to onboard new users, what fees to show upfront. Those decisions now decide who thrives in digital finance and who stays on the fringe.

The headline numbers look simple: more adults with bank accounts, mobile-banking use climbing, smartphones spreading faster. Yet below those metrics sit contradictions — between apps and agents, sleek interfaces and data costs, regulatory ambition and market speed. The phone has become not just a tool but a rulebook that banks must learn to write fluently.

The practical work of remaking apps

Not every bank launched a new app with noise and banners. Some rolled out subtle redesigns, others went for full relaunches that reset their mobile strategy.

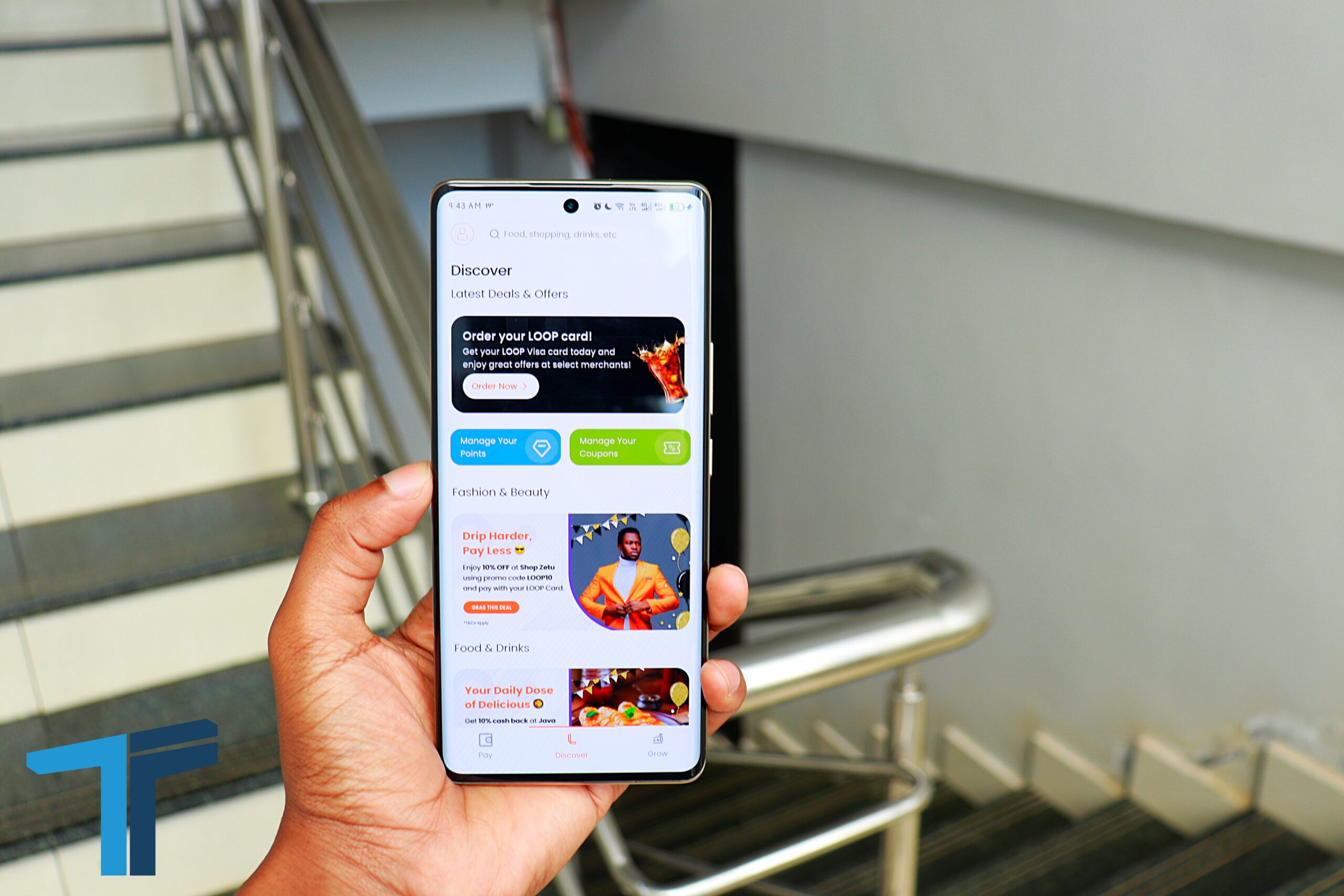

KCB led one of the boldest releases in mid-August 2025, introducing a rebuilt KCB Mobile with faster load times, stronger security and a mini-app layer that lets third-party services live inside its ecosystem. Equity took an earlier turn, merging EazzyBanking into Equity Mobile during its February–March 2024 migration. The rebuild brought new remittance options and scheduling tools. NCBA’s NCBA NOW added end-to-end digital account opening by May 2025, removing one of the last frictions for first-time users. LOOP, its lifestyle-banking offshoot, refreshed its interface in February 2025 with clearer navigation and new features such as Money Pools and virtual cards.

Safaricom’s M-PESA app also belongs in this timeline. The company is preparing a full rollout in November 2025 after months of behind-the-scenes testing. The rebuild introduces a modular design that brings payments, lifestyle services, and government utilities under one roof. It adds support for joint accounts and folds Fuliza, M-Shwari, and KCB M-PESA into a unified view, underscoring how deeply mobile-led finance now shapes daily transactions in Kenya.

Other lenders chose quieter routes. Co-operative Bank, DTB and Stanbic pursued steady updates rather than a total rebuild. Absa and Standard Chartered made smaller interface refinements. Fintechs like Tala and Branch polished their onboarding and loan tools through routine app-store updates rather than public rollouts. Each approach carries intent: a public relaunch shows strategy; incremental updates show discipline.

What product choices reveal

Feature lists are not just technical upgrades; they are statements of intent. Banks that streamline onboarding or verification want new accounts at scale. Those that focus on security and performance are banking on trust. And when a high-street lender positions its app as the default for daily transactions, it is making a claim — that convenience and complexity can coexist.

But progress does not erase friction. Data costs still cut many users off. Agents remain the fallback for those who prefer a face to ask. App reviews hint at deeper truths: confusing fee displays, login failures, and error messages that feel opaque. Digital speed is outpacing emotional confidence.

The commercial tug

Kenya’s financial ecosystem is a contest over who owns the rails. Mobile money platforms still dominate micro-transactions. Banks hold the regulatory strength and balance sheets for larger value flows. Where the two cooperate, the customer journey feels seamless. Where they don’t, fragmentation leaves users toggling between apps, unsure where one service ends and another begins.

Regulators hover over the field, trying to encourage innovation without letting it outrun safeguards. The Central Bank’s stance has been flexible but firm — approving digital expansion while warning against over-leveraged lending and hidden fees. The equilibrium remains delicate: every new feature risks drawing fresh scrutiny.

Reading the road ahead

The next phase of mobile banking in Kenya will not arrive as a single story. It will unfold through patterns — some promising, some messy. One version sees banks surrendering low-value transactions to mobile-money apps while building deeper credit and savings tools. Another imagines a widening divide: high-polish apps for middle-income users and stripped-down wallets for everyday trade. There’s also the path where regulation tightens, slowing innovation but protecting users from the blind spots of automation.

Yet there’s a quieter, more hopeful thread: that design itself becomes a form of inclusion. If banks simplify interfaces, trim data demands and make costs transparent, the unbanked edge could draw closer to formal finance. The question is less about which app looks modern and more about which one feels human enough to trust.

The quiet race beneath the numbers

Progress is not always visible on charts. It shows in how fast a payment clears, how clearly an app explains its fees, how few steps it takes to open an account. Those are the new battlegrounds of trust. The phone in a user’s hand is both a branch and a mirror — it reflects what the financial system values and what it forgets.

Kenya’s mobile-finance map is being redrawn line by line, click by click. The real outcome will not be decided by who has the flashiest app, but by who builds tools that people can afford, understand and rely on every day.

Go to TECHTRENDSKE.co.ke for more tech and business news from the African continent.

Mark your calendars! The GreenShift Sustainability Forum is back in Nairobi this November. Join innovators, policymakers & sustainability leaders for a breakfast forum as we explore sustainable solutions shaping the continent’s future. Limited slots – Register now – here. Email info@techtrendsmedia.co.ke for partnership requests.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke