Kenya’s Most Trusted Mobile Money Service Prepares to Unveil Its Upgraded M-PESA App This November

The November launch of a reimagined M-PESA app could reshape how millions interact with digital finance

When Safaricom announced that M-PESA would briefly go offline on the night of September 22, most Kenyans likely shrugged. After all, the three-hour disruption — scheduled from 11:59 p.m. to 3 a.m. — falls at a time when the country is mostly asleep. Yet beneath the surface, the downtime tells a larger story: M-PESA is being re-engineered for its biggest leap forward in years.

This November, Safaricom will roll out a new M-PESA app built on what it calls Fintech 2.0, a platform designed to deliver faster, safer, and smarter financial services for millions of Kenyans. For a service that already processes over 125 billion transactions annually, these upgrades aren’t about cosmetics. They are about survival in a market where downtime, even for a minute, can ripple through the economy.

Why this upgrade matters

At its peak today, M-PESA can handle about 4,000 transactions per second. That number sounds vast until you realize the system is already brushing against its ceiling. Engineers are racing to push capacity to 8,000 TPS by 2026, with each step forward requiring careful system rewiring and brief outages like the one planned next week.

In practical terms, this means smoother performance when millions of people send money simultaneously — from matatus accepting cashless fares in Nairobi, to businesses settling bulk payments, to families wiring school fees in rural towns. Reliability is no longer a luxury; it is the backbone of M-PESA’s role in the economy.

The November reveal

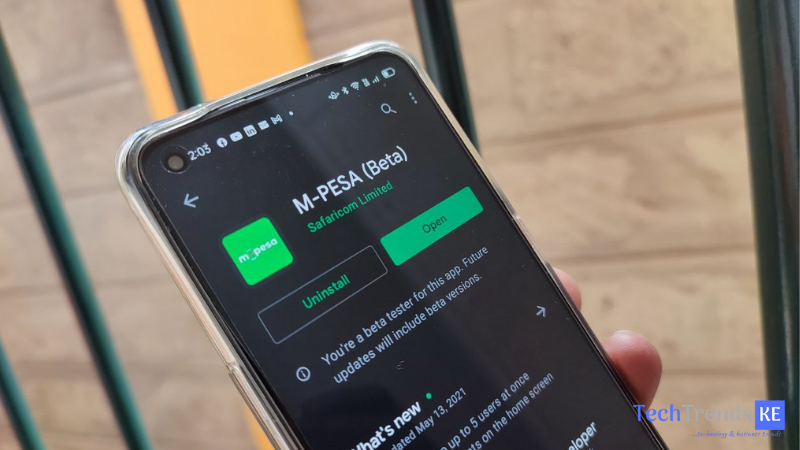

The downtime is essentially a dress rehearsal for November’s bigger announcement: a fully upgraded M-PESA app. Unlike earlier iterations, this one is built on Fintech 2.0 architecture, a shift Safaricom says will unlock new possibilities in security, speed, and personalization.

The app is expected to move beyond simple transfers into a broader digital financial hub. With over 45,000 integrations and 100,000 developers already tied into M-PESA’s ecosystem, the new platform could pave the way for smarter lending products, richer merchant tools, and a smoother user experience for everyday transactions.

Building for resilience

Behind these technical upgrades is a clear bet: M-PESA must remain not only Africa’s most trusted mobile money platform but also its most resilient. That’s why Safaricom has been steadily migrating the system onto cloud-native infrastructure, ensuring it can reroute traffic in minutes if a failure occurs.

In a world where one minute of downtime could stall 240,000 customer requests, resilience is more than an engineering milestone. It is economic insurance.

The bigger picture

By the time the new app lands in November, most users will only notice the fresh design and faster load times. What they won’t see is the thousands of servers, the sharded databases, and the months of testing that underpin it. But that’s precisely the point. M-PESA has always thrived on invisibility — money that moves so seamlessly it feels almost natural.

Safaricom’s challenge now is to preserve that reliability while scaling into the future of digital finance. The September 22 downtime may be a small inconvenience, but it’s also a reminder: behind the tap of a button lies one of Africa’s most ambitious financial engineering projects.

Go to TECHTRENDSKE.co.ke for more tech and business news from the African continent.

Mark your calendars! The TechTrends Pulse is back in Nairobi this October. Join innovators, business leaders, policymakers & tech partners for a half-day forum as we explore how AI is transforming industries, driving digital inclusion, and shaping the future of work in Kenya. Limited slots – Register now – here.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke