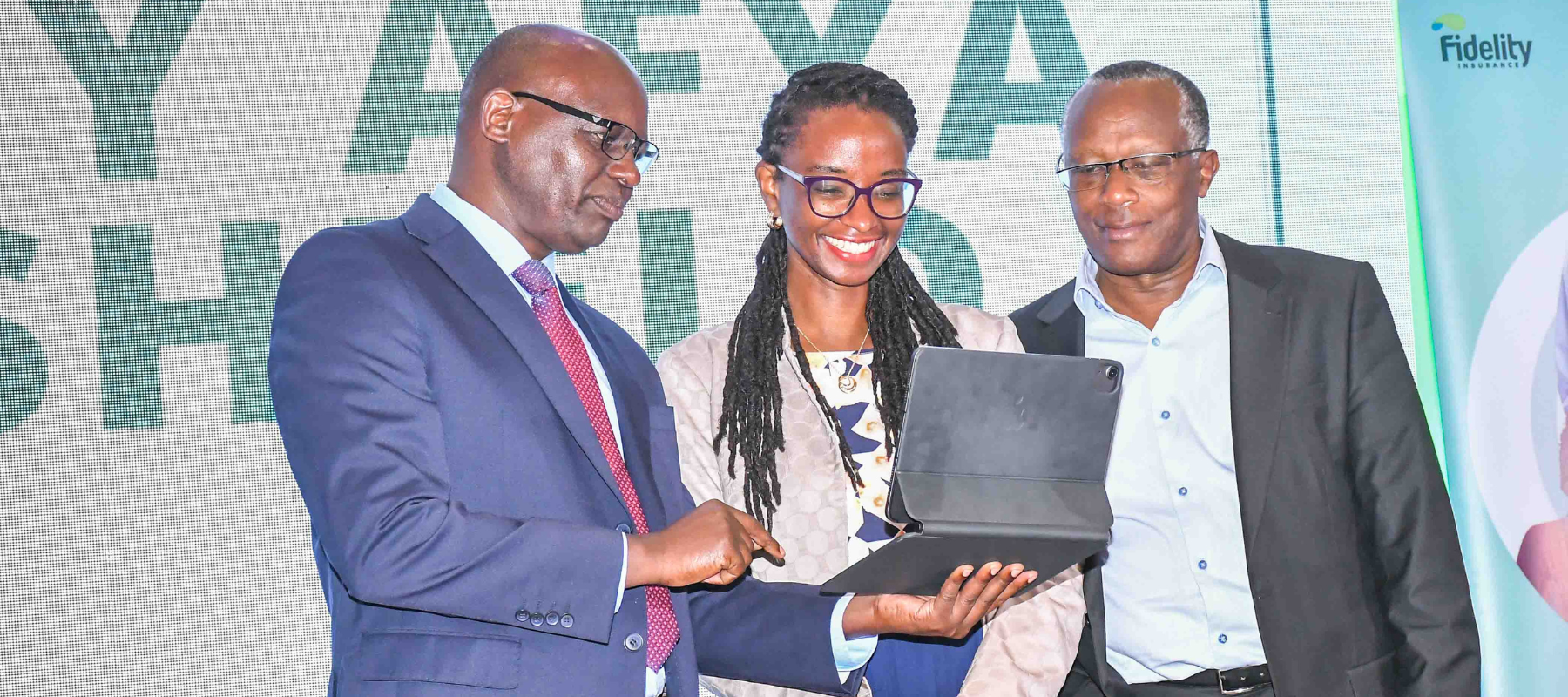

Fidelity Shield Insurance launches ‘My Afya Shield’ digital product

Fidelity Shield Insurance has launched My Afya Shield, a pioneering health coverage product designed to transform healthcare access in Kenya. This initiative reinforces Fidelity’s commitment to prioritizing preventive healthcare and enhancing wellness among its members.

My Afya Shield offers an extensive range of benefits, including access to treatments, vaccines, counseling services, mental wellness support, rehabilitation services, and personalized wellness programs. Notably, it includes coverage for alcohol and drug abuse rehabilitation as a standard feature, along with regular health check-ups.

Underwritten by Fidelity Shield Insurance, My Afya Shield is accessible through a digital platform that seamlessly connects Fidelity members with a nationwide network of healthcare providers.

Users of My Afya Shield can initiate treatments from the user-friendly digital interface, monitor benefits and limits in real-time, and easily locate and access care at healthcare providers. They also have the flexibility to add family members as dependents. The platform further facilitates efficient claims processing and timely payments to healthcare providers, improving the overall healthcare experience.

Moreover, My Afya Shield integrates with M-TIBA, to enhance access to healthcare services. M-TIBA is a mobile wallet developed by several partners including Kenya’s largest telco, Safaricom, and allows users to set aside funds for healthcare. It seamlessly integrates with My Afya Shield access to grant benefits for Fidelity members and their dependents.

Richard Marisin, Managing Director of Fidelity Shield Insurance, expressed excitement about the launch, saying, “We are happy to introduce My Afya Shield as a health coverage product designed to address the evolving needs of our members. This launch solidifies our commitment to delivering comprehensive and technology-driven solutions for healthcare access.”

My Afya Shield leverages digital technology, allowing customers to conveniently apply for services online and minus the requirement for paper forms. Following the launch, it is expected that the product will gain rapid uptake allowing millions of Kenyans to gain comprehensive health coverage, including traditionally uninsured benefits like vaccinations, mental health, counseling, and rehabilitation services.

Follow us on Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke