CBA Partners With AGF and ECAP To Launch Faster Payments Solution For Corporate Suppliers

Commercial Bank of Africa (CBA) in partnership with African Guarantee Fund for Small and Medium-sized Enterprises(AGF) and ECap a Nairobi – based fintech firm has today launched a solution that will see suppliers of corporate institutions, receive payments for goods and services offered, without having to wait for the stipulated credit period.

Through this solution known a Reverse factoring corporate buyers will approve and submit their supplier’s invoices to CBA through an online platform and the bank, in turn, facilitates immediate payments to suppliers with recourse to the corporate buyers.

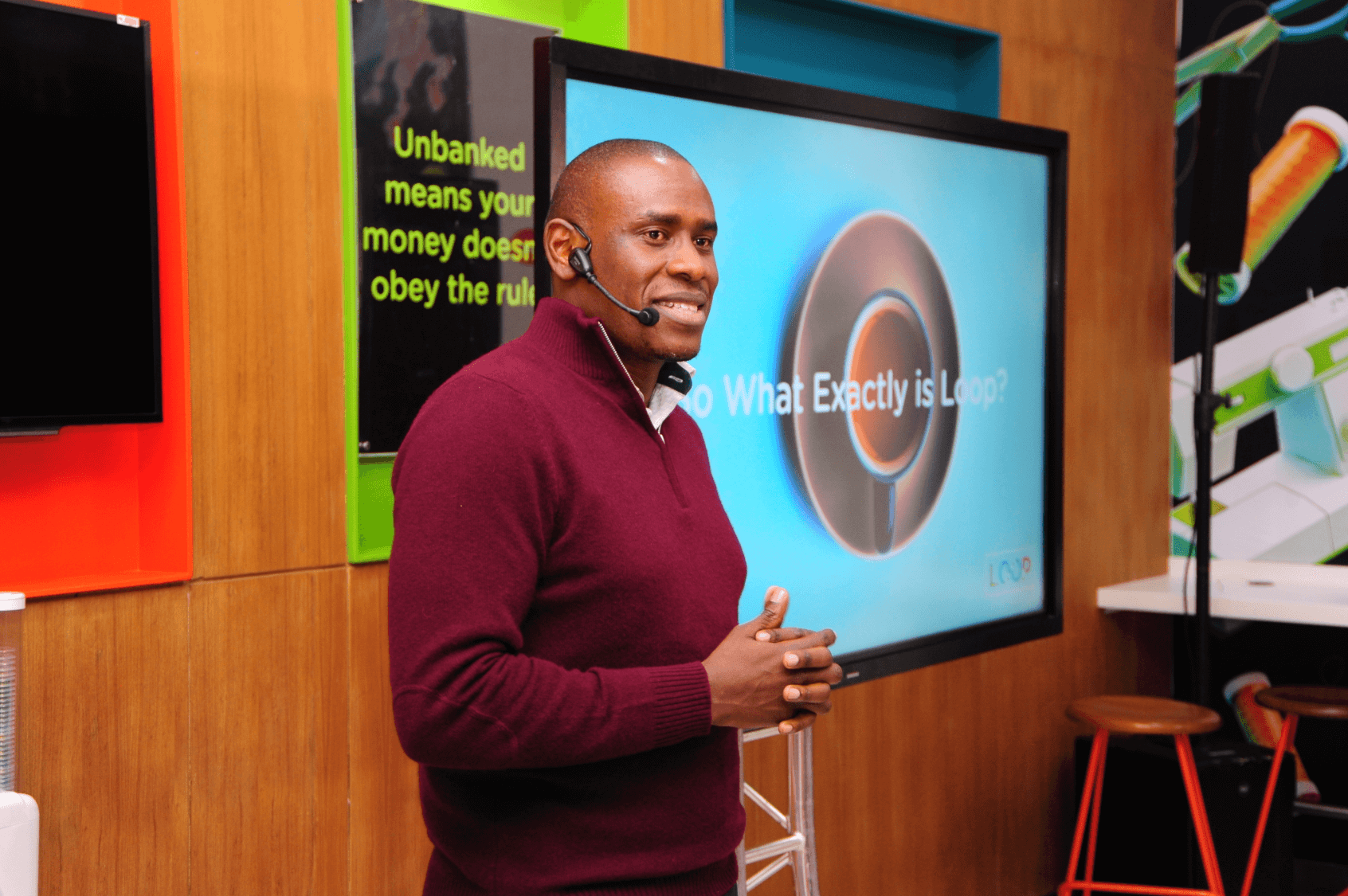

‘’ This is yet another innovative solution that we are introducing for our corporate Banking segment. We have leveraged technology and teamed up with the leading provider of financial guarantees across the continent, to address some of financial guaranteed across the continent, to address some of the key concerns affecting business today. In particular, this solution will spur growth among small and Medium Enterprises (SME) by availing working capital faster to enable them to finance new projects,’’ said Jeremy Ngunze, Chief Executive Officer, CBA Kenya.

Unlike the traditional invoice discounting offered by Banks to suppliers, reverse factoring or supply chain financing will be extended to corporate customers as long as they have good credit standing with CBA.

The solution is also expected to reduce the administrative burden placed on procurement and finance teams as this responsibility will now be extended to CBA, which will manage all the payments on behalf of corporate clients.

Reverse factoring model has been successful in the United States of America, Europe, South Africa and some countries in Asia.

The launch was also attended by the CEO of African Guarantee Fund, Mr. Felix Bikipo.

CBA becomes the first Kenyan bank to offer the solution through an Open platform, which gives participating buyers access to liquidity.