[Updated: OKash Compliance] Opera’s Predatory Loan Apps With Crazy Interest Rates Still Exist On Google Play Store

Opera’s main browser business has not been doing well. Since it went public, the company’s browser market share has immensely dropped from over 5% to just over 2% recently.

Business has been bad in the current era of Chrome dominance, and that has to led Opera to rethink its business model and create multiple streams of income.

Plan B? Predatory Opera loan apps.

According to research from Hindenburg Research, the Opera has created multiple loan apps with short payment windows and outrageously high-interest rates in the tune of ~365-876%!

The company has multiple predatory loan apps in Africa and Asia. In Kenya, there is OKash and OPesa, CashBean in India, and OPay in Nigeria.

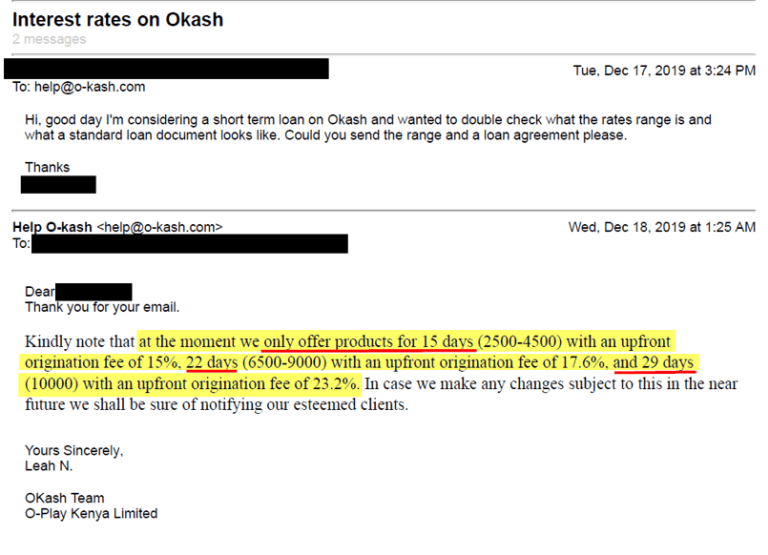

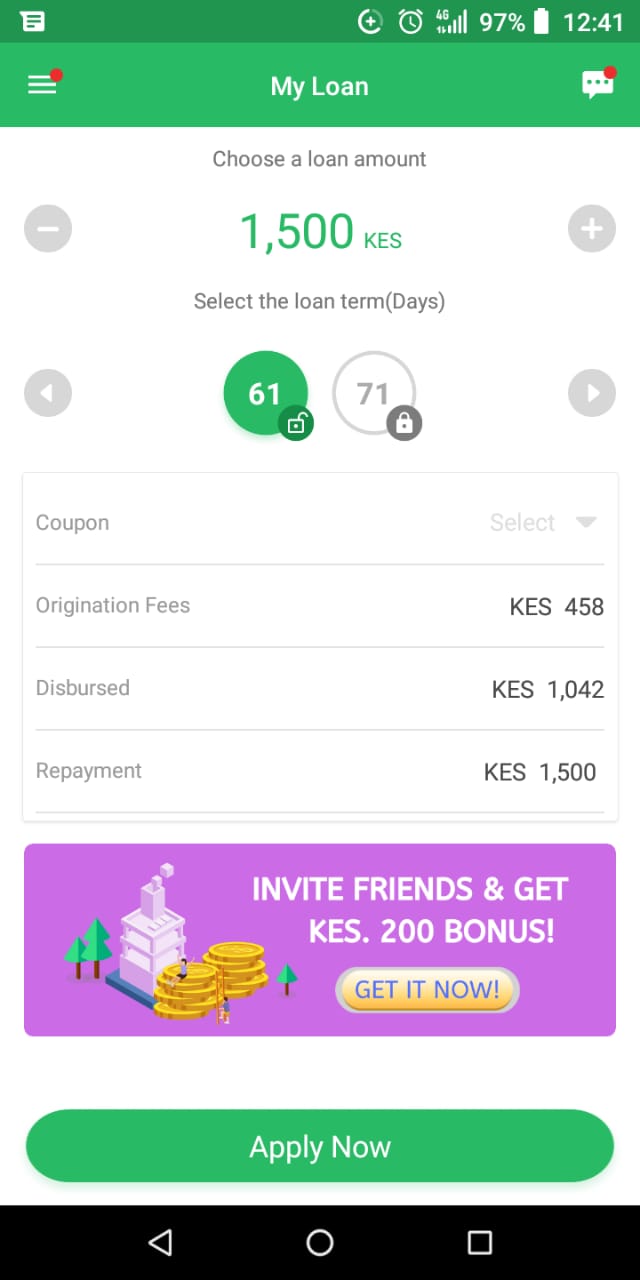

The apps have managed to remain on the Play Store (OPesa cannot be found anymore) by advertising interest rates that are not realistic. A good example is Okash, which said its tenure ranges between 91-365 days. As of now, the app says its 61-365 days, which contradicts the company’s statement in an email response which says they only offer loans from 15-29 days.

This violates Google Play Store laws enacted last year on predatory loan apps.

“We do not allow apps that promote personal loans which require repayment in full in 60 days or less from the date the loan is issued (we refer to these as “short-term personal loans”) read Google’s updated policy on loan apps.

Update: We reached out to OKash help team and they were not updated with the new updates regarding compliance. When we reached out they still said they offered loans with repayment window of 15 to 61 days.

However, the app’s repayment terms were updated yesterday(19th) to comply with Google Play Store updated policies. So now you can borrow from as low as Ksh 1500 and pay after 61 days.

“Apologies for the 15 days oversight as this was way before Google Play came up with the new policies that we are strictly adhering to. At the moment we are offering products with repayment periods of between 60 and 365 days,” said the company’s spokesperson in response to TechTrendsKE.

Other apps – including OPesa, CashBean, and OPay – were also found violating this rule in variable extents.

In Kenya, we have also seen Okash users report that the apps were sending text messages and could even call people in your contact list if the loan has defaulted. This practice was legal at the time since the company’s terms and conditions had clearly outlined the conditions. According to Hindenburg Research, a former employee says the company has since ceased this practice.

Still An Ailing Company

Despite having a portfolio of predatory loan apps, the company’s financial situation is not in good health. The short-term loans business now accounts for over 42% of the company’s revenue and has been a significant contributor to the massive growth, according to Hindenburg Research.

Notably, the business has also suffered; “the segment experienced massive defaults (~50% of lending revenue), and company-wide cash flow has worsened.”

Since the apps, main distribution channel has been via Google Play Store, “this entire line of business is at risk of disappearing or being severely curtailed when Google notices,” reads a statement in the report.

Hindenburg Research noted that it found evidence showing that the company is redirecting investor money to other companies.

“We have a 12-month price target of $2.60 on Opera, representing ~70% downside,” says Hindenburg Research. As of now, the company stock is selling at $7.055 (09:43, Jan 20th, 2020)

Update Jan 20th, 3:20 PM: Included OKash Compliance

Update Jan 23rd, 10:24 AM;

Opera responded to the report saying it “the report contains numerous errors, unsubstantiated statements, and misleading conclusions and interpretations regarding the business of and events relating to the Company.”

On the other hand, like OKash, the company has also updated OPesa and CashBean quietly to comply with the Play Store policies. The tenure now ranges from 61-365 days.

Follow us on Telegram, Twitter, Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates.

2 Comments