The Kenyan Automotive scene has been growing over the last couple of years. A 2016 report by Deloitte suggests that there is even more room for growth in local vehicle sales.

In fact, a number of automotive manufactures have recently committed to increase production activity in Kenya. Earlier this year, France’s Peugot announced plans to restart its production in the country 15 years after halting its manufacturing operations. This was was after Germany’s Volkswagen inaugurated a new production facility in Thika toward the end of 2016. In the first phase the Volkswagen plant will have an annual production capacity of up to 1000 vehicles. This is expected to open more room for local vehicle consumption.

Companies like Japan’s Toyota and US-based general motors already have presence in the country. Additionally, in March last year the US-based manufacturer Daimler Trucks Asia began the process of setting up presence in Kenya’s second largest city, Mombasa.

The entry of these companies into the country can be attributed to the increased consumer demand for vehicles. Taxi businesses such as Uber, Taxify and Little Cab have also brought with them an increase in demand. In a country of 44 million people, the total vehicle fleet stands at just over 1.3 million, putting the ownership rate at around 28-29 vehicles per 1000 people. Majority of these vehicles are second hand sold by dealers and online platforms such as Checki.

A new Cheki DF Automotive Report however recommends that risk averse dealer should stock up on older cars( 6yrs and above) as they exhibit less volatility. The report also found out that Relatively newer cars (0- 5yrs) reversed some of its gains by 28.46% in Q1–2017.

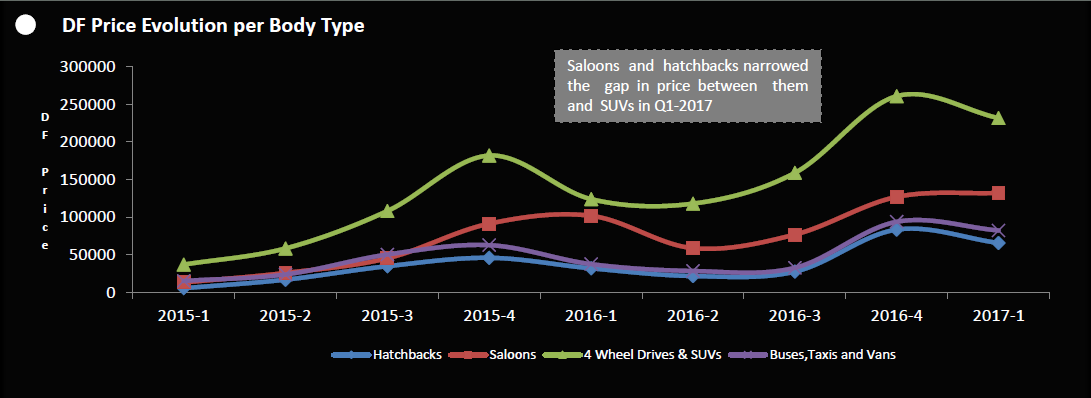

The report the found out that the Auto market prices were however down in Q1-2017. The Q1-2017 Trailer Average price registered the slowest decrease, abandoning only Ksh. 49,338 compared to Q4-2016.

The report also found out that trucks was the biggest gainer in Q1-2017 having previously in Q4-2016 contributed 3%to the distribution. SUVs were the biggest loser in Q1-2017. It had 49% of the distribution in Q4-2016. Bigger car engines (2500 cc and above) also recorded the highest drop in prices, losing 16.61% in Q1-2017, compared to Q4-2016. What this means is that cars with bigger engines have volatile prices and risk averse dealers should avoid them.

In terms of brand popularity, Toyota continues to be the most popular car brand in Kenya followed by Mercedes Benz. BMW is however the biggest climber in the chart jumping three positions in Q1-2017, to its current third place. Nissan, Land Rover , Subaru come in 4th, 5th and 6th respectively followed by Volkswagen, Mitsubishi, Honda and Audi. This popularity was a measure of the activity and interest of visitors, as well as the available stock on the marketplace, for a specific brand.

The Cheki DF Automotive Report analyses auto valuation and consumer demand in the Kenyan marketplace for specific criteria such as body type, vehicle age, engine capacity and mileage. The market insights are provided by Data Fintech, based on data collected from Cheki.co.ke, the first automotive online marketplace in Kenya over a period of 2 years (January 2015 to March 2017.)