Apple’s Cautious Approach to AI Shows Cracks in Tim Cook's Strategy for the Post-iPhone Era

Apple once set the pace for the tech world, but in the race to define the future of AI, it’s starting to look like a company without a map.

Apple has never been in the business of rushing. The company has long preferred calculated execution over early bets—waiting to enter a market until it could do so with polish and scale. That approach built the iPhone, reinvented wearables, and helped the company hit a $3 trillion valuation. But in 2025, that same instinct is starting to look like inertia.

Fifteen months after Apple introduced its AI suite, dubbed Apple Intelligence, key features still haven’t shipped. Personalized Siri—pitched as the next big leap for the iPhone—remains absent from devices. Internal delays, limited developer access, and vague timelines have left users with more questions than answers. The company has gone silent on ads promoting the system. Publicly, executives say it’s coming. Privately, no one seems to know when.

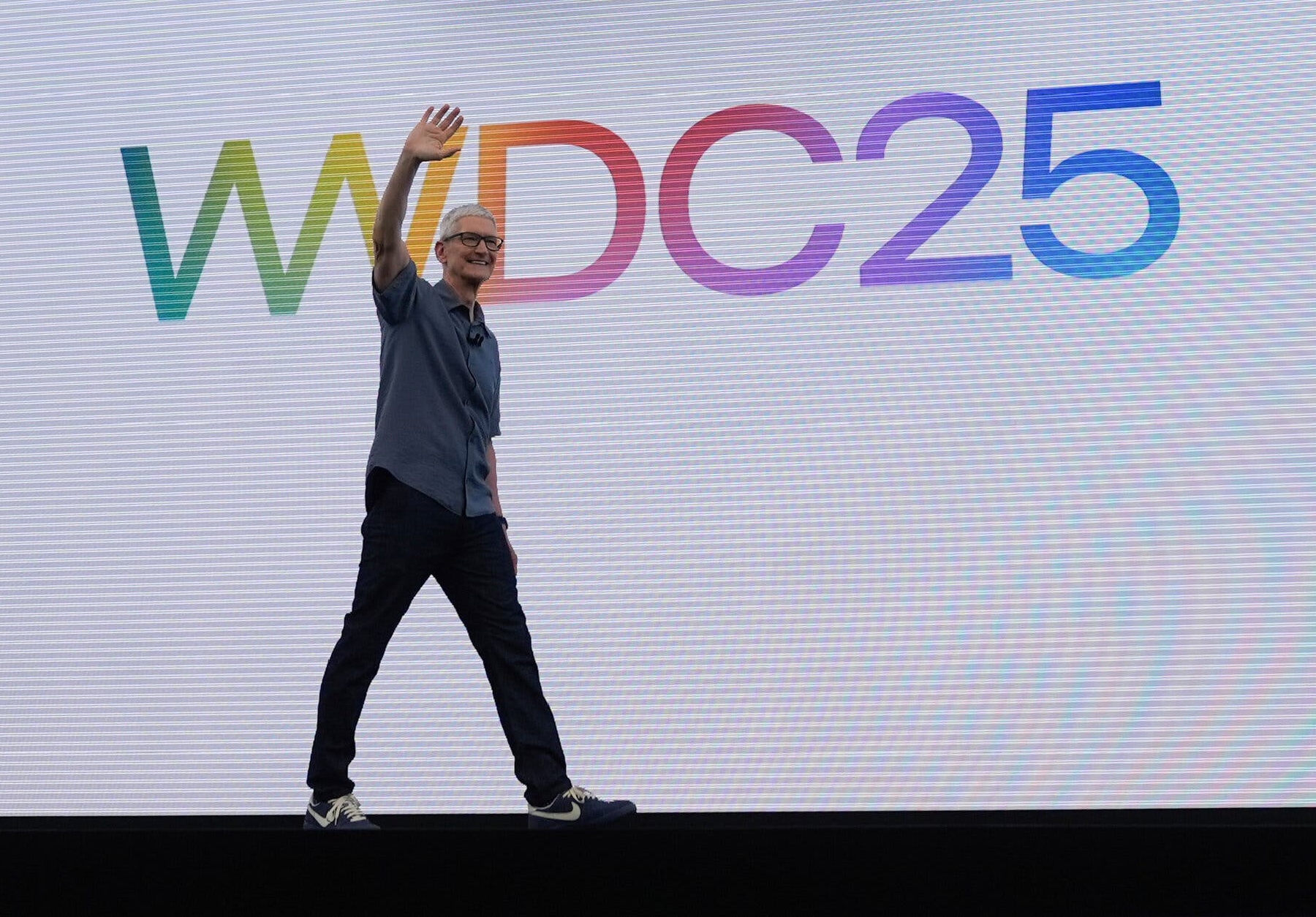

At the heart of the issue is Tim Cook’s approach to product strategy. For more than a decade, he has steered Apple to record profits by refining operations and maximizing hardware margins. But AI isn’t a supply chain problem—it’s a vision problem. And for the first time in his tenure, Cook’s reputation as a steady hand is under pressure.

Other firms haven’t waited. Microsoft’s Copilot is now baked into its Office suite. Meta’s Llama models are powering assistant features across its apps. Google’s Gemini AI, flawed as it was at launch, has iterated aggressively. Nvidia, meanwhile, has become a market mover in its own right—supplying the chips that power this entire transformation. Apple, the company that once ridiculed others for following, now looks like it’s trailing.

Hardware Alone Won’t Hold the Line

Apple’s product lineup tells the same story. The iPhone remains dominant, but its design hasn’t meaningfully changed in half a decade. The Vision Pro, once hailed as the start of a new spatial computing era, launched to muted demand and minimal software support. The company canceled its long-running electric vehicle project. And it has yet to announce anything that signals a significant AI-native hardware shift.

Internally, design leadership remains unfilled after Jony Ive’s departure. Key AI talent has left for competitors. And while Apple maintains tight control over its chips, OS, and hardware—a rare advantage in this AI race—it hasn’t demonstrated what it plans to do with that control.

Cook’s defenders argue that Apple tends to arrive late, then take over. That was true with the iPod, iPhone, and iPad. But those were Steve Jobs-era products. Under Cook, there’s been more optimization than reinvention. Now, the tech landscape is reshaping itself again—this time around generative AI—and Apple has yet to prove it can lead.

Strategic Exposure in China Adds Pressure

Beyond AI, Apple faces a geopolitical squeeze. Its manufacturing base in China—once a source of unmatched efficiency—is becoming a liability. In the June quarter, Apple fell to fifth place in Chinese smartphone market share, behind local brands like Huawei and Xiaomi. Attempts to shift assembly to India have been slow, limited in scope, and hampered by export restrictions and workforce challenges.

Cook’s relationships in Washington and Beijing once gave Apple rare access and insulation. But even that advantage appears to be fading. Trade tensions, visa blocks, and rising competition from domestic Chinese tech firms are compounding Apple’s challenges.

A Strong Balance Sheet, But Fewer Bold Moves

Financially, Apple remains in strong shape. It has a massive war chest, loyal customer base, and more than a billion active devices. But growth has slowed. Revenue gains have averaged just over 2% across the last three years—well below peers like Microsoft, Alphabet, and Nvidia.

Analysts are starting to ask harder questions. Not just about the delayed AI rollout or the aging iPhone design—but about Apple’s long-term direction. With competitors leaning aggressively into AI-native platforms, Apple’s next chapter seems unclear.

The company turns 50 next year. The brand remains iconic. But the ground is shifting beneath it.

If Apple’s next move is coming, it needs to arrive fast—and it needs to be more than an update. Because the market, and the moment, won’t wait.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke