Many African fintechs still grappling with regulatory challenges, report

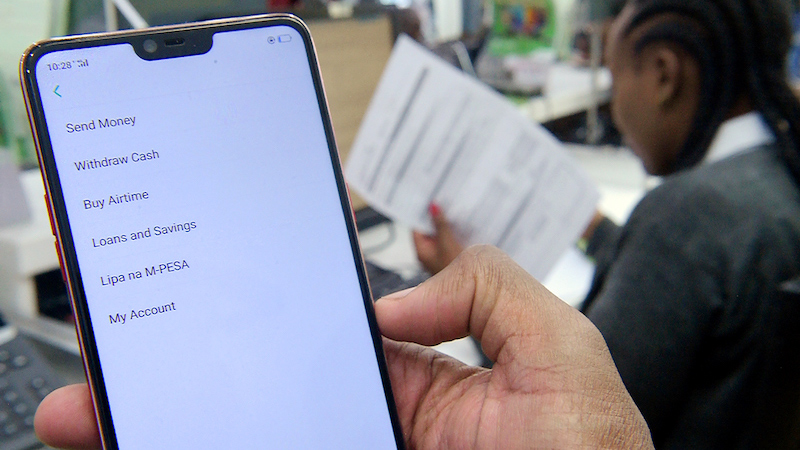

The African fintech industry has been actively involved in driving the digital transformation of the continent by presenting innovative solutions for fostering financial inclusion and easing cross-border payments plus access to financial services.

Despite these huge opportunities, most fintech firms still grapple with major regulatory issues that impede their growth and wider market adoption.

There are 54 countries in Africa, each having its financial regulations, central bank policies, and compliance requirements. Such diversity makes the continent a complex landscape for fintechs trying to scale across multiple markets. For instance, a firm willing to extend its operations from Kenya to Nigeria would have to grapple with two completely different sets of regulations. This makes cross-border expansion very laborious and expensive.

In some countries, central banks, financial regulators, telecommunications authorities, or other government bodies (in addition to those specifically in charge of digital innovation) are put fintechs under a stack of overlapping regulations. These layers of bureaucracy often result in redundant processes, non-uniform licensing, and slowness in decision-making that cumulatively hampers how smoothly these fintechs can operate.

According to the ‘’Unlocked Potential Fintech In Africa’’ report released by BDO, Regulations vary significantly across different African countries, creating complexity for pan-African Fintech companies.

The report explores how transformative technology within the African Fintech landscape has the potential to shape a more inclusive and prosperous future for the continent

Additionally, the report notes that regulations are constantly evolving, requiring agility from Fintech firms.

The report highlights the lack of harmonised and clear regulations for fintech across different countries and regions as one of the challenges facing fintechs in the region, Other includes gaps and inconsistencies in the legal and supervisory frameworks, challenges in implementing and enforcing the regulations, and lack of coordination and cooperation among the regulators and other stakeholders.

Regulatory Sandboxes: More Needs to Be Done, A Step in the Right Direction

To try and address some of these challenges, a number of African regulators have introduced “regulatory sandboxes”—which are controlled environments where fintech startups can test their solutions under relaxed regulatory conditions. Countries which include Kenya, Nigeria, and South Africa have initiated such programs permitting Fintechs to test, and innovate without being burdened by full regulatory oversight from the word go.

While sandboxes are a step in encouraging innovation, they are not entirely workable. Firstly, because the frameworks are not set up in all the countries, there is an issue of universality in access. And second, even after a fintech leaves the sandbox, it has to still, at a later stage, abide by all the regulations and concerns that the regulatory environment can raise. Besides, as it operates nation by nation, a fragmented regulatory environment equally challenges the sandbox model from border areas.

B.D.O on the report is calling for African countries to enhance regulatory clarity and transparency and adopt a balanced and proportionate approach to regulation that fosters innovation while ensuring consumer protection and financial stability.

It is also calling on these countries to develop and implement common standards and guidelines for fintech, strengthen the collaboration and dialogue among the regulators and the fintech industry as well as establish regulatory sandboxes and innovation hubs to test and support new fintech solutions.

Follow us on Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke