Unpacking The State of Fintech in Africa

The fintech sector in Africa has recorded rapid growth over the recent years to emerge as one of the most vibrant fintech ecosystems worldwide.

The continent’s challenges, including low banking penetration, high levels of the unbanked population, and the mobile phone usage boom, offer a fertile land for innovations to take place.

In most African countries, fintech has become a strong facilitator for financial inclusion, delivering access to financial services to millions of unbanked individuals and businesses that have historically been beyond reach.

Mobile penetration and connectivity have been described as key drivers of this growth. In areas where there is no physical banking infrastructure, the mobile phone has enabled leapfrogging by essentially bypassing traditional methods and moving to mobile-based financial solutions. Mobile money platforms in countries such as Kenya, Nigeria, and Ghana now allow customers to make transactions with just a phone number; expanding to more sophisticated products such as savings, loans, and insurance.

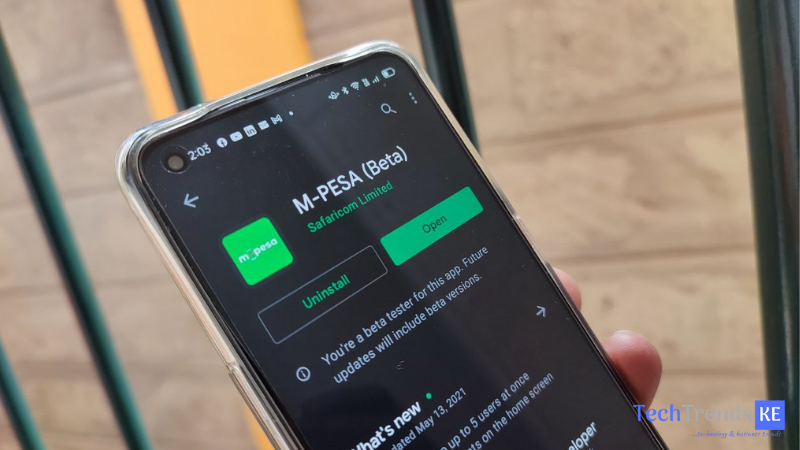

‘’The telecoms sector has witnessed remarkable growth in fintech, giving rise to “Mobile Money” (MoMo) in Ghana, Nigeria, Mpesa in Kenya, and Ecocash in Zimbabwe. These fintech platforms are propelled by mobile giants such as MTN, Vodafone, and Econet, revolutionising the traditional finance sector through fintech’’. Terence Hove, Financial Markets Strategist Consultants to Exness.

Another key driver is the large unbanked population. Over half of Africa’s population remains unbanked—a whopping 60%, according to World Bank estimates. Fintech companies have emerged to address this gap, providing banking services for those left underserved. This trend is common in East Africa but it is also extending into West Africa; particularly in Nigeria which is Africa’s largest economy and now one of the most energetic fintech ecosystems on the continent. Fintechs like Flutterwave, Paystack, and Interswitch have set up payment infrastructures that have enabled companies to process transactions smoothly across the continent.

Favorable regulatory environment is also driving this growth. Governments across the continent are now slowly starting to take fintech seriously.

Regulators in countries like Kenya, Nigeria, and South Africa have begun actively working to set up a framework that supports innovation while also keeping financial stability in check. Central banks are also increasingly recognising the role of fintech in promoting expanded access to financial services, leading to new regulations aimed at creating an enabling environment that promotes competitiveness while protecting the consumer.

The fintech sector in Africa has drawn enormous attention from global players, with investment firms foraying into the continent. In 2021, African fintech startups have raised over $2 billion, an amount that has never been achieved, with big funding into companies like OPay (Nigeria), Chipper Cash (Ghana), and Wave (Senegal). This has increasingly placed investors flocking into this space because the African market is big and unserved and, secondly, there is the ability to scale digital solutions.

Top fintech markets in Africa

In West Africa, Nigeria leads as the largest fintech country. With a huge population skewed heavily toward youth and a booming tech ecosystem, Lagos has quietly become the counterbalance to Nairobi in all things fintech innovation. It is also the home country of Flutterwave and Paystack, two startups at the forefront of cross-border payments which have earned international acclaim. The Central Bank of Nigeria has also taken initiatives in developing a framework for regulating digital currencies as well as fostering cashless transactions.

In East Africa, Kenya has emerged as the birthplace of Africa’s fintech journey, having been the base for the onset of M-Pesa way back in 2007. Ever since, Kenya has maintained itself as an innovation hub, especially in mobile money and lending. The fintech ecosystem in East Africa has grown from the basic offerings to wealth management, insurance, and SME financing, among others, with Ugandan and Tanzanian sectors set to emulate Kenya.

In Southern Africa, South Africa is an important fintech player in the African landscape. Its financial system is more mature compared to other regions, with established banks increasingly partnering with fintech companies to deliver digital banking services. Blockchain and crypto use have also been on the rise in the country as companies explore decentralized finance (DeFi) solutions.

In North Africa, Egypt is also slowly emerging as a Fintech hub. With a population of more than 100 million and high smartphone penetration, the country has emerged as an attractive market for fintech solutions, especially in the domain of digital payments and lending. Investment in Egyptian Startups has surged with Fawry and Paymob being in the driver’s seat. Key Trends

Fintech is indeed redefining Africa’s financial landscape, fostering financial inclusion by extending individuals and businesses access to finance through innovative financial solutions. Fueled by robust mobile technology, favourable demographics, and surging international investment, the prospects for fintech in Africa appear promising. However, ensuring that the continent addresses issues related to regulation, infrastructure, and financial literacy is very important if the sector is to realize its full potential.

Follow us on Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke