Kenyan fintech Power raises $3 million in seed funding

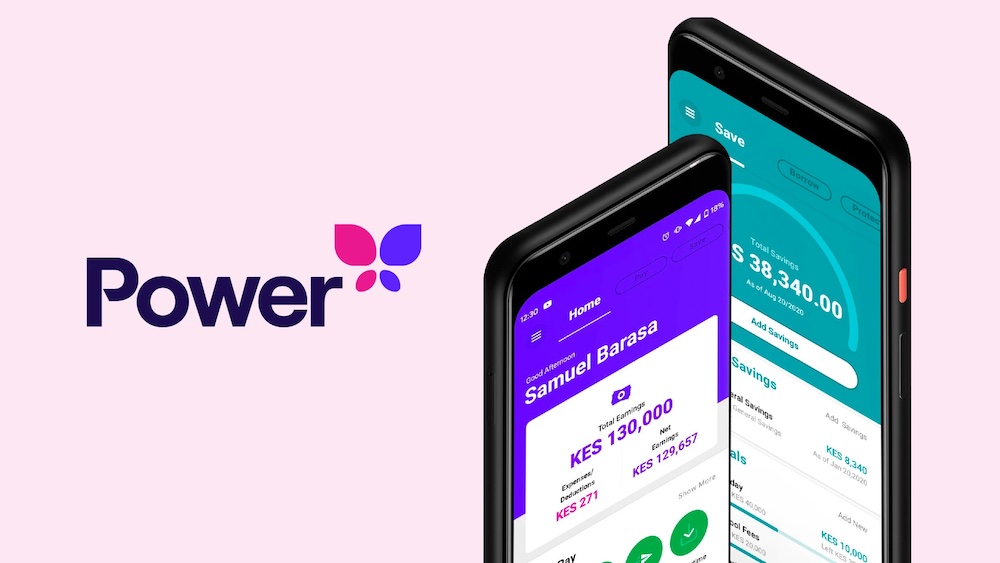

Power Financial Wellness, a Kenyan fintech startup that seeks to advance the financial well-being of its customers has secured a $3 million seed funding.

The startup partners with companies and enables their employees to access short and long-term loans, investment opportunities, and insurance products. Power lends only to employees and contractors (gig workers) of companies they have on-boarded on their platform.

“Once we connect into a company, we already know how much the individuals are earning, how long they’ve worked there. We know whether they’re full-time, part-time contractors, or gig workers. We connect with the credit bureau in real time to pull information on other facilities they might have in the market.” Brian Dempsey, Power Coufounder said

The fintech company has so far on-boarded 75 companies in Kenya, giving it a stronghold of more than 40,000 workers. The company says it has so far disbursed more than 1.5 million in loans since launch, with plans to onboard over 200 companies in Kenya.

The startup was founded by Brian Dempsey and Chandra Singh in 2020. Dempsey, the company’s Chief Executive Officer who has long experience working in the African microfinance sector says that nearly 65% of workers in the continent don’t have solid savings. He said that they spend all their money in the first five days of the month, leaving them at the mercy of experienced digital loan lenders.

“We focus on helping workers access affordable and appropriate financial services,” Dempsey said.

With the backing of the $3 million seed round, Power Financial aims to scale its operations in Kenya and expand into Zambia. The funding was led by DOB Equity with participation from Bolt by QED Investors, Quona Capital, Zephyr Acorn, and Norrsken Accelerator.

Follow us on Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to info@techtrendske.co.ke