Data firm Periculum launches Utambuzi, a personal financial management tool

Periculum, a data analytics firm that uses machine learning to provide real-time solutions to individuals and organizations has introduced Utambuzi, a personal finance management product aimed to help users manage their income and expenses.

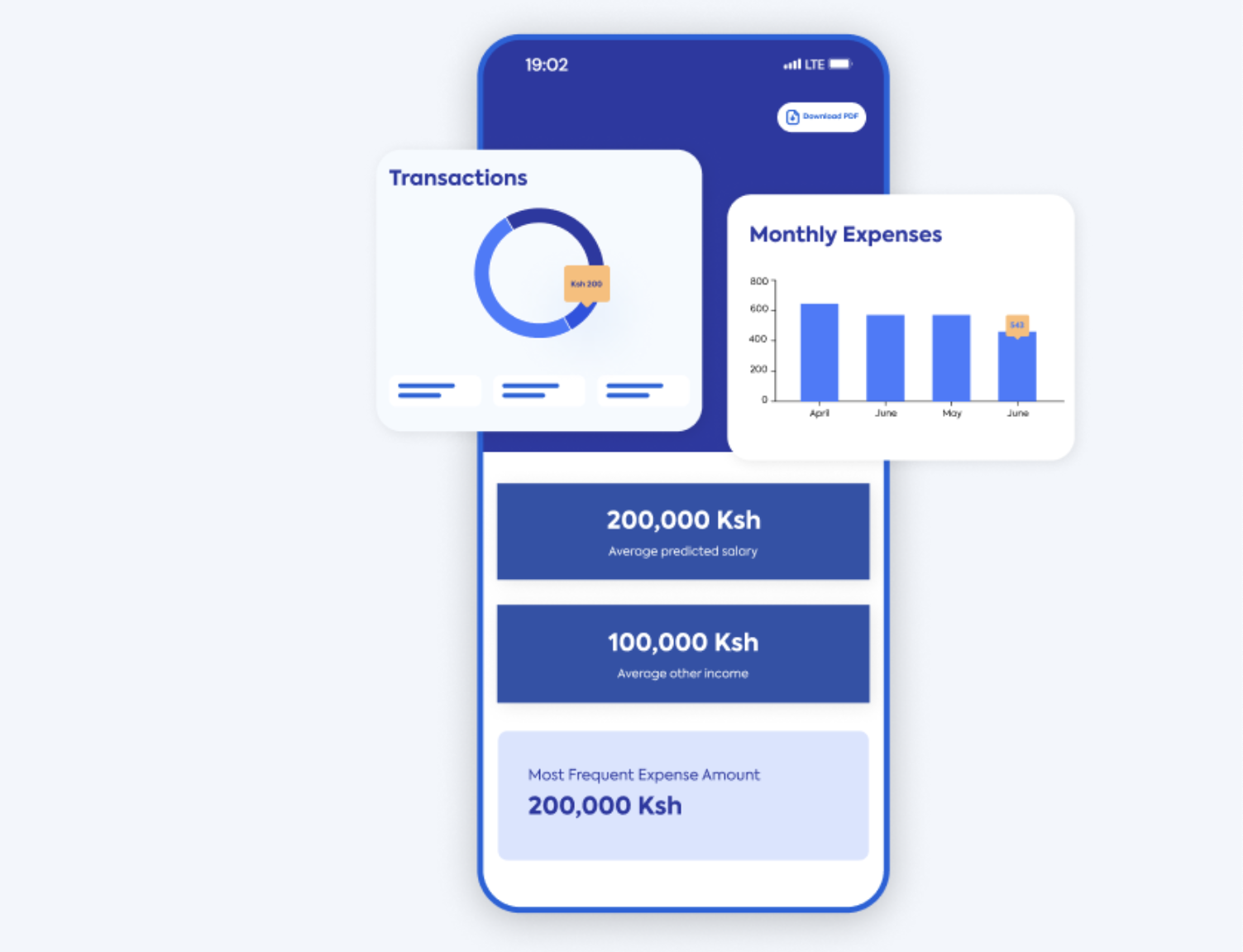

Utambuzi is a Swahili word that loosely translates to ‘insights’ or ‘diagnosis.’ The tool is built to help users get valuable insights into their financial behaviour and help to better align their expenses with their financial goals. It also uses machine learning to detect suspicious transactions and alert the user.

Speaking at the launch, Michael Collins, Periculum’s founder and Chief Executive Officer, said “Africa needs domestic credit to stimulate real economic growth. And this is not only bank-to-business credit; it can also be personalized lending for short-term credit as well as buy now, pay later merchants. “

Collins noted that the continent lacks tech-enabled credit assessment infrastructure which limits the quality and quantity of lending. The team believes that this tool gives consumers the power to make the right financial decisions, especially while engaging lenders.

“The rhetoric that lenders or banks’ should dictate how consumers use their services is discarded as users can from the comfort of their homes download the mobile app or use the web app and choose which credible lender they want to use their services,” the company said in a statement.

From the lenders’ point of view, they have access to already verified borrowers and just need to request their analyzed data that shows the KYC and affordability of the borrower. The product erases the need for lenders to manually or virtually verify borrowers.

Follow us on Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to info@techtrendske.co.ke