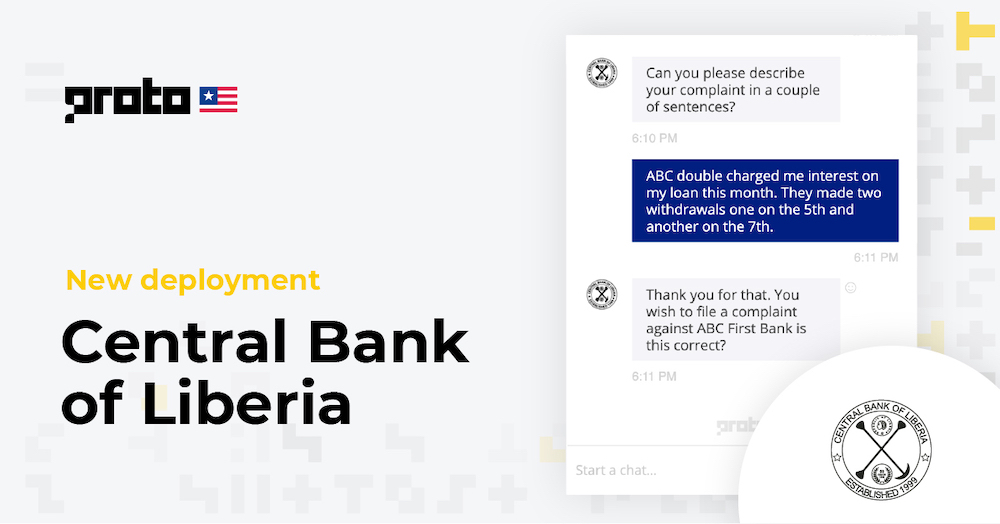

Central Bank of Liberia deploys chatbot to expand access to financial consumer protection

The Central Bank of Liberia (CBL) has unveiled a chatbot that empowers consumers to instantly file complaints against their financial institutions and insurance providers for misconduct and poor service.

The central bank partnered with Proto, a leading provider of inclusive chatbot technology, to deploy the AI Customer Experience (AICX) solution nationwide to help consumers seek recourse against their financial service providers.

After complaints are lodged with the Central Bank of Liberia chatbot, the concerned banks or insurance companies have five days to respond to the consumer, while the CBL monitors the progress and quality of the response. The technology helps guarantee consumer protection and is under deployment with additional African financial regulators in Côte d’Ivoire, Ghana, Rwanda, and Zambia, following its original deployment with the Central Bank of the Philippines (BSP). The BSP chatbot has notably handled a 4x usage surge during the pandemic, and is now supporting strengthened consumer protection legislation.

The CBL chatbot is deployed via its website and Facebook Messenger, with support for SMS forthcoming to include consumers with feature phones only.

The technology will be key in addressing the poor service that consumers can face with financial service providers, especially as the sector continues to grow with many new service providers that have short track-records and under-developed consumer engagement practices. This deployment also comes at a time when the CBL is driving a major increase in financial inclusion from 18.8% in 2011 to 50% in 2024, expecting more first-time financial consumers in need of protection than ever before.

“Access to financial consumer protection in the country is limited largely due to consumer engagement primarily occurring via email, in-person contact and manual complaint channels that rely upon consumers’ ability to fluently speak or write in English.” CBL Director of Supervision and Regulations Fonsia Mohammed Donzo said.

With this deployment, financial consumers in Liberia – especially those from historically marginalized groups – now have improved access to financial consumer recourse, and the Central Bank of Liberia has set a new standard for conversational banking service delivery in Africa.

“The Proto AICX solution will enhance the Central Bank of Liberia’s financial inclusion drive and further boost consumer confidence in the financial sector,” Donzo added.

“This chatbot is available via highly-accessible channels, which are essential for including ordinary consumers. In addition to the immediate benefit of improved consumer recourse, this solution has the wider potential to increase overall trust in the fairness of Liberia’s growing financial sector.” Proto CEO Curtis Matlock said.

Follow us on Telegram, Twitter, Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to info@techtrendske.co.ke.