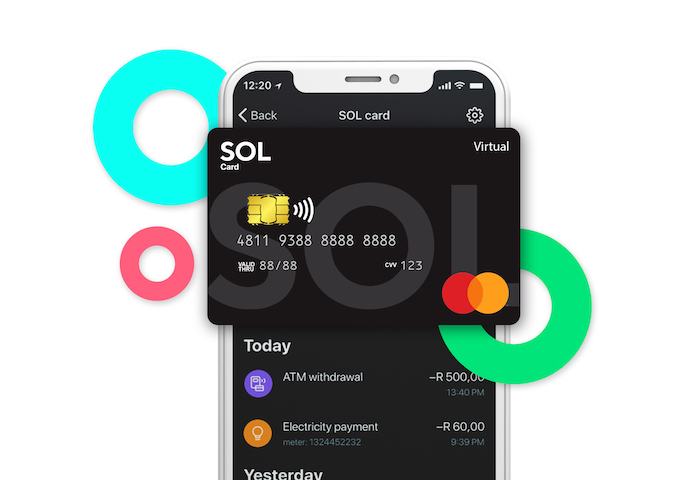

South African fintech startup SOL has announced that it’s rebranding to SOLmate. The online payment platform that offers clients a digital wallet facility, has also unveiled a new product offering, a virtual card that it says places unbanked and underbanked clients at the centre of SOLmate’s business offering.

The new virtual card provides clients with the ability to shop online safely, and to draw cash from various retail stores – making SOLmate one of the first fintech players to offer a virtual card to FICA lite customers who would otherwise not have had access to digital financial services.

With a new tagline of “Your money. Your life. Your way.” SOLmate says it aims to build a digital community platform for South African consumers that allows safe custody of money and a convenient payment platform, along with access to other financial and lifestyle products, services, and rewards.

The startup will offer an entry level product, created for lower-income individuals with limited access to financial services. In the coming months, it says it will introduce a traditional bank account for unbanked consumers looking for a convenient, easy-to-use alternative.

With a SOLmate account, users can deposit their salary into their account to transact and purchase basic products and services through the app, seamlessly bridging the gap between businesses and clients.

SOLmate has kept every cost to a minimum and waived many of them where possible – making it affordable and accessible for all – with accounts starting from as little as R15 per month.

“This rename and new virtual card offering represents a significant step in the company’s evolution. The positioning perfectly illustrates our growing ambition in the market and how we aim to always put our customers first above all else.” Says Jonathan Holden, COO of SOLmate.

“The SOLmate name is rooted in the company’s commitment to being the preferred choice and trusted partner to our customers. We pride ourselves in our relationships with clients and our ability to help, support, and connect people to their money quickly and easily,” he adds.

Follow us on Telegram, Twitter, Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to info@techtrendske.co.ke

One Comment