Global Smartphone Production to Reach 1.36 Billion Units in 2021, Report

Global smartphone market expected to gradually recover in 2021

2020 was a tough year for various industries around the globe owing to the COVID-19 pandemic. The smartphone market wasn’t exempt from the economic slump as users shied away from upgrading their devices.

In correspondence to the decline in demand, smartphone companies produced fewer phones in 2020.

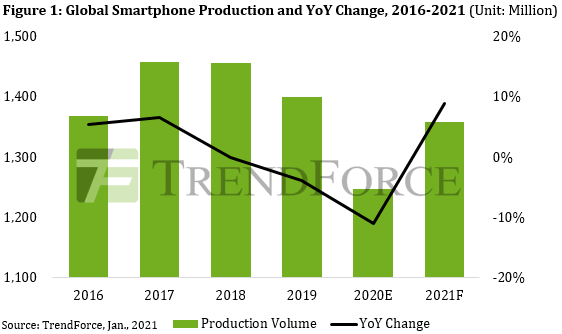

The global smartphone production dropped at a record-breaking 11% from the previous year to 1.25 billion units, according to a recent report from TrendForce.

This year, the company anticipates an uptick in smartphone production to hit 1.36 billion units, a 9% increase from 2020. The company expects consumers to get used to the new normal that will gradually recover the smartphone market.

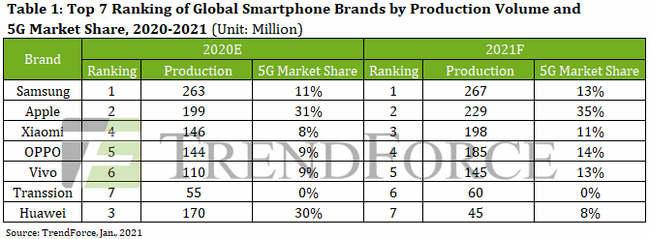

Despite immense pressure from the US, Huawei ended 2020 as number three by production volume following Apple, while Samsung, a long-running market leader, finished at the top. Xiaomi, OPPO, and Vivo wrapped 2020 at number four, five, and six, respectively, by production volume.

TrendForce expects Huawei to experience a “significant decline” in smartphone production ‘cause of the US export controls and the Honor spin-off. The Chinese tech company is anticipated to finish 7th in device production volume this year.

The research firm expects the 2021 top 6 list of companies by production volume to include Samsung, Apple, Xiaomi, OPPO, Vivo, and Transsion – maker of Infinix, Tecno Itel smartphones. Together the top 6 list will control 80% of the global smartphone market, TrendForce predicts.

However, there’s still uncertainty in the market due to the pandemic. The company believes the pandemic still plays a major role and will continue to do so this year.

Besides, performance may also vary this year partly because of “geopolitical instabilities” and lack of available production capacity in the semiconductor foundry market.

Follow us on Telegram, Twitter, Facebook, Youtube, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates