How Technology is Revolutionizing and Unifying Africa’s Forex Markets

Forex markets in Africa have historically been fragmented, with things like varying regulations, currency fluctuations, and limited accessibility affecting seamless trading for traders across the continent.

Technology is, however, changing this, playing a very important role in unifying these markets and making it easy for Africans to trade more efficiently and transparently.

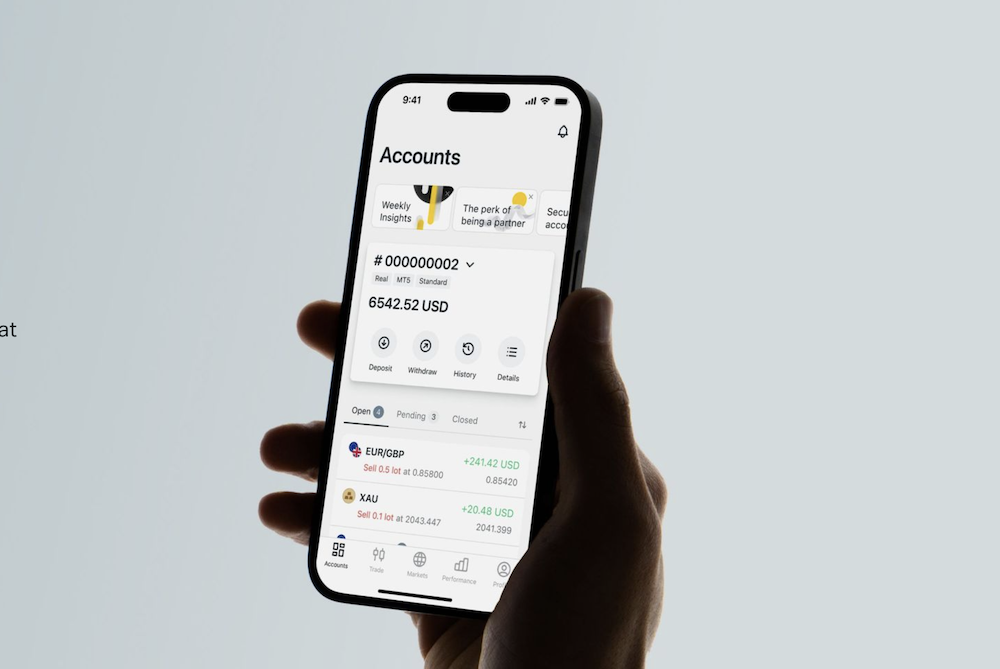

One of the major ways in which technology is closing the gap is through digital forex trading platforms. These platforms offer real-time access to currency exchange rates, enable automated transactions, and connect traders across different regions. Mobile apps have made forex trading more inclusive, allowing traders to transact from wherever they are without relying on formal financial institutions. With the emergence of fintech innovations, forex transactions are now within instant reach, minimizing the inefficiency that results from manual processes and red tape.

Blockchain technology is another major factor that is helping to unify the forex market in Africa. Decentralized ledger systems help ensure transparency and security so that risks of fraud against the currency can be mitigated. Cryptocurrencies and digital assets are also creating alternative trading options, reducing the dependency on volatile fiat currencies. With the help of blockchain, cross-border transactions are becoming easy to carry out and also cheaper and faster—sharply addressing challenges posed by currency conversion and transfer hight fees.

Forex trading companies are also using Artificial intelligence (AI) and big data analytics to enhance decision-making in forex trading. Using AI-driven algorithms, these firms are able to analyze vast amounts of data, which helps to predict currency movements and market trends, giving traders insights that improve their trading strategies. Automated trading systems are helping reduce human errors and helping investors make informed decisions based on real-time analytics.

Additionally, AI-powered customer support services like chatbots are improving user experiences on trading platforms, ensuring traders have access to market insights and assistance when needed.

Another area where technology is playing a key role is regulatory harmonization. Digital platforms and centralized forex exchanges are helping many African governments and financial institutions create more standardized regulations. These efforts aim to reduce barriers to entry for traders and businesses while increasing confidence in forex markets. With regulatory frameworks supported by technology, cross-border trading is becoming more seamless and secure.

Despite these advancements being realized, there are still a number of challenges, including issues of internet connectivity in rural areas, cybersecurity risks, and financial literacy amongst users. However, continuous technological innovations with the growing investments in digital infrastructure in Africa is accelerating the process.

The consolidation of the forex markets in Africa through technology is unlocking new economic opportunities and promoting cross-border trade while also improving financial inclusion. As the digital transformation gains momentum, forex trading in Africa is going to be a lot more streamlined,, offering both traders and businesses a much more efficient and profitable market landscape.

“Technology is a not only revolutionary but also a necessary tool that allows us to provide our African traders with a truly seamless experience”, says Quoc Dat Tong, Senior Financial Markets Strategist at Exness, “using innovative applications, we have managed to mitigate and almost completely eliminate issues such as limited accessibility and a varied regulatory landscape. For example, a digital forex platform provides market access without the potential limitations of a formal financial service provider. It also removes any and all geographical barriers, since the only thing the trader needs for market access is an internet connection. And that is completely changing what we can offer to our clients.”

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke