Microsoft and the Africa Legal Network (ALN) Academy have called on the Financial Services Industry to increase AI capacity for professionals. This they say is to enable and prepare the current and next generation of professionals to think and act alongside technology.

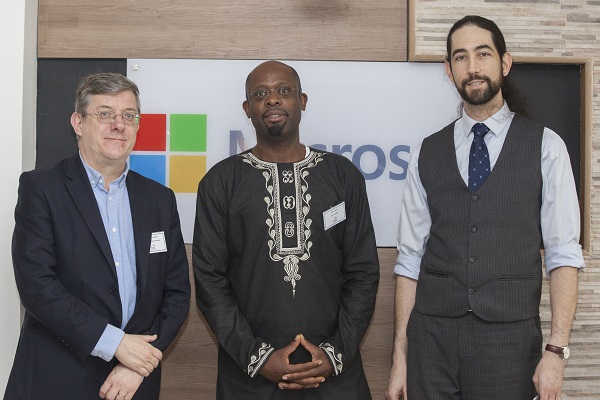

This rallying call was made during a roundtable event titled “Brave New Way”, hosted at the Microsoft Policy Innovation Centre to raise awareness around the best practices and development of guidelines for artificial intelligence (AI) and distributed ledger technology in the financial sector and related areas.

According to Otilia Phiri, Microsoft Attorney – Emerging Markets, Middle East & Africa, the only way to realize the value and the transformational opportunities presented by these technologies requires collaborative roles between governments, civic society, private sector and citizens.

“As Digital Transformation across industries reaches peak intensity, we have seen historical barriers to trade evolve. As our trade structures change, it has become imperative for our views on governance and compliance to also progress,”said Otilia Phiri.

He noted that the economic opportunities that emerging technologies like AI and Blockchain offer cannot be ignored.

”It has been estimated that AI could contribute up to $15.7 trillion to the global economy by 2030, more than the current output of China and India combined. Here in Kenya, this opportunity has been recognized in various ways including the establishment of the Blockchain and AI Task Force and the recently launched regulatory sandbox offered by the Capital Markets Authority” he added

ALN Academy has made digital transformation discourses a central thematic area within its overall offerings. According to Femi Omere Executive Director of ALN Academy, it is vital that capacity building efforts are able to prepare the current and next generation of professionals to think and act alongside technology, and in ways that are centred around the holistic improvement of human relations and service experiences.

“Best practice sharing within the industry can accelerate the development of risk-based principles guiding the adoption, use and governance of emerging technologies like AI and Blockchain particularly within the financial services sector, but by no way exclusive to this field. It is by remaining at the centre of the developments in technology that the human effort, inclusive of that eye to determine intrinsic value, shall remain relevant. The current and next generation of professionals will not only need to embrace technology but will also need to develop holistic approaches to understanding human relations and service experiences, especially as they relate to AI.” said Femi Omere.

The event also sought to address concerns around impending risk. “When one looks at AI, historically there have been concerns around what the workplace of the future will look like. Will automation result in widespread job losses? Will human interfaces or interactions be replaced by intelligent technology, or will there be a “human in the loop”? And with the rise of privacy regulation, we are also encountering concerns about the use and potential abuse of personal data. Our debates should focus not on whether these changes will take place, but rather on how and when, particularly looking at how we safeguard the populace.” says Malcolm Dowden, Legal Director – Womble Bond Dickinson (UK) LLP.

“Emerging technologies like AI and Blockchain have the power to transform the financial services industry in significant ways like we have seen the mobile phone and the rise of mobile payment solutions like MPESA impact financial inclusion in Kenya for example. Some of the use cases of AI in Financial Services include applications to assess credit quality, for automating client interaction (we have already seen the surge of customer service bots) and to price or market insurance offerings. For blockchain we’ve already seen early adopters leverage the innovation for trade finance (simplifying letter of credit processes for example), for automating compliance and for driving payment settlement efficiencies continues Otilia.

Notwithstanding the commercial opportunity presented by AI and DLTs, as we navigate the opportunity they present for Africa, we should also keep in mind how these emerging technologies can be leveraged to solve some of society’s biggest challenges and consequently support our sustainable development agenda.

Follow or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates.