How Mobile Apps are Streamlining Online Trading

Online trading in Africa has continued to experience massive growth over the last couple of years. This growth can largely be attributed to the latest technological advancements and the emergence of mobile trading apps.

These mobile apps have not only brought a facelift to the financial markets but also made trading very easy, efficient, and convenient for both new and experienced traders.

One of the biggest advantages of trading apps is that they allow users to trade from anywhere at any time. While traditional trading platforms require physical presence or desktop-based tools, mobile trading apps have made markets available in real-time, a fact that has opened opportunities for young Africans who found trading cumbersome and seemingly out of reach.

Moreover, these apps offer real-time market data, as and when it happens, on stock prices, currency exchange rates, and other market indicators. They also come fitted with advanced analytics tools such as charts, insights from AI, and predictive analytics that enable traders to make a better assessment of the market trends and investment opportunities.

“Mobile apps and AI have redefined the way traders engage with the financial markets. Looking back to what trading used to be in the 1970s, it’s really impressive how far technology has evolved. While AI can help decision-making, it shouldn’t be taken for granted. Traders must still practise risk management and ‘do their homework’”, Quoc Dat Tong, Senior Financial Markets Strategist at Exness, notes.

Many trading apps also now integrate algorithmic and automated trading features. Using these tools, users can set predefined rules for buying and selling assets, reducing the need for manual execution. Algorithmic trading, for example, minimizes emotional decision-making and ensures efficiency in executing trades, particularly in volatile markets.

Traditional brokerage firms often charge very high fees and commissions, which make trading a less attractive option for investors. Trading apps, on the other hand, have significantly brought down the transaction costs with free commission models, allowing even small-scale investors to participate in the financial markets without high charges.

With security being one of the major concerns in online trading, modern trading apps now come with features like advanced encryption, multi-factor authentication, and biometric verification. This ensures that users’ accounts and funds remain secure at all times. Other features that are incorporated in these apps are fraud alerts and anti-hacking measures to safeguard against unauthorized transactions.

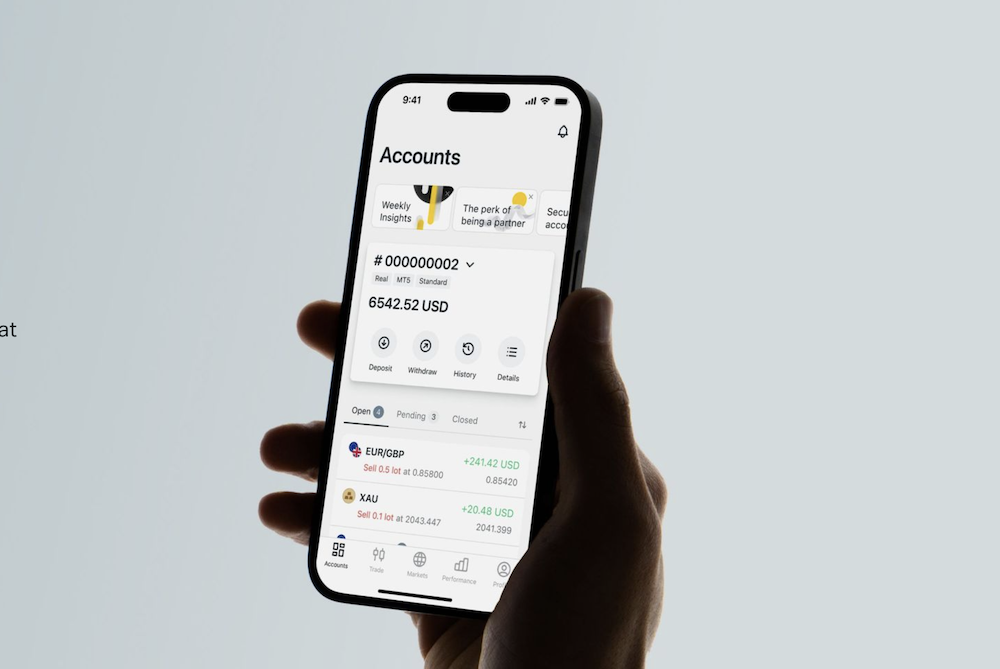

Most of these trading apps also come with user-friendly interfaces, which has become a top priority for most of them. You get features like customizable dashboards, instant notifications, and integrated payment options, are make trading more efficient. Some of these apps even work with banking systems and digital wallets, as well as third-party financial services, which makes the entire experience better for traders.

Online trading mobile apps have indeed changed how people participate in financial markets by making the process more accessible, cheaper, and safer. In particular, real-time market analysis, automation, and improved security are features that make the apps continue to redefine online trading.

As technology evolves, we can expect even more sophisticated trading solutions that will further remove all barriers and ensure transparency of all investments across the globe.

Follow us on WhatsApp, Telegram, Twitter, and Facebook, or subscribe to our weekly newsletter to ensure you don’t miss out on any future updates. Send tips to editorial@techtrendsmedia.co.ke